Why did Solana go bankrupt? Is the reason why PI coins are listed on Binance?

Mar 03, 2025 pm 09:54 PMSolana's recent price decline may be related to the potential Binance listing speculation of Pi Coin (PI). Binance's poll showed that 86% of participants supported the listing of PI coins, which could attract a large amount of capital to flow into PI, causing some Solana investors to turn to PI.

Solana price plummeted: Will PI coins replace SOL and become the first choice for investors?

Solana (SOL) price has fallen sharply recently, falling 16% last week and 37% last month. Loss of key support levels has heightened investor concerns. While the overall crypto market downturn is partly responsible, the panic selling of traders has exacerbated the decline.

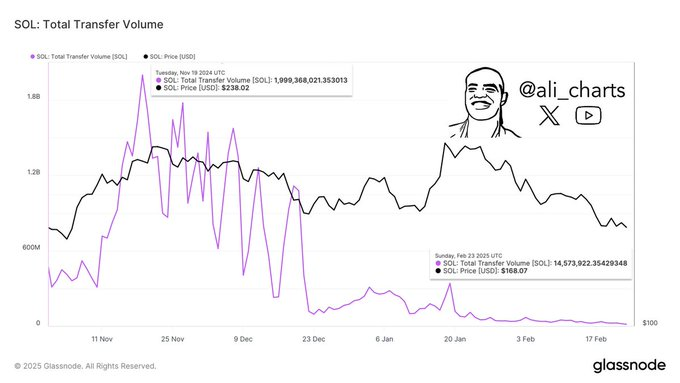

Solana network activity has dropped significantly, with transaction volume plummeting from $1.99 billion in November 2024 to $14.57 million (Glassnode data), raising concerns about the long-term prospects of SOL.

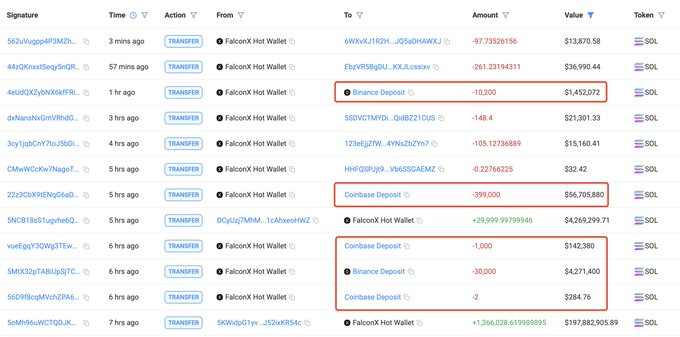

Whale Sale: A huge $198 million sale shocked the market

Solana Whales recently sold $198 million worth of $1,366,028 SOL and transferred to FalconX, which then transferred some of the SOLs to Binance and Coinbase, further exacerbating the market's selling pressure.

This large-scale sell-off triggered panic among retail investors, with trading volume falling 18% to $13 billion, and the market was highly bearish.

Solana faces a key support level of $130

Crypto analyst Ali Martinez pointed out that the SOL price trend is showing a bearish technical pattern. If the key support level of $130 cannot be maintained, it may fall further to $65.

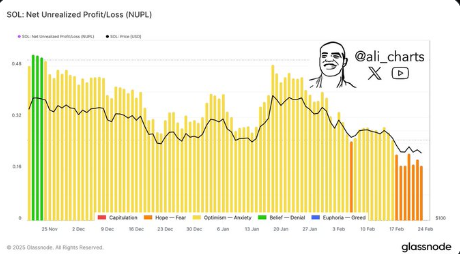

Glassnode's net unrealized profit/loss (NUPL) indicator shows that Solana investor sentiment has turned into "fear", in sharp contrast to optimism in the previous months.

Is the listing of PI currency Binance the reason for the decline of SOL?

The potential listing of Pi Coin (PI) may also be one of the factors behind Solana's decline. Binance poll showed that 86% of participants supported the listing of PI coins, which could cause funds to flow from Solana to PI. After the PI currency is listed, the expected return is 100 times.

Will traders abandon Solana and turn to Pi Coin?

Pi coin price has risen 21% to $1.90 recently, with trading volume soaring 22% to $878 million. Solana prices fell 50% from their 2024 high of $264, aggravating speculation that investors are shifting funds from SOL to PI. After Binance launched PI currency, more than 200 million users may drive the price of PI currency to soar further.

Solana Price Forecast: Key Support and Resistance Levels

Solana is currently close to the key support level of $103.84 (0.786 Fibonacci retracement). Holding this support level may rebound to $260.91 (short-term resistance), $314.58 (medium-term target) or even $377.29 (long-term bullish target). But if it falls below $103.84, it may accelerate to $65.

The future direction of Solana?

Solana prices fell sharply, affected by market downturn, whale sell-offs and changes in investor sentiment. The potential listing of PI coins may further divert investment in SOL. Whether Solana can rebound depends on whether it can hold the key support level and break through the resistance level. The listing of PI coins may further weaken the attractiveness of SOL. Investors need to pay close attention to Solana's price trend and judge whether it is a value investment opportunity or a sign of further decline.

Solana Long-term Price Forecast (2026-2036)

The following is Solana's long-term price forecast, for reference only and does not constitute investment advice:

(The content of the form is the same as the original form, omitted here)

Is SOL a good investment?

Investing in Solana depends on your risk tolerance. SOL has fluctuated significantly recently, so you need to study it carefully before investing.

The above is the detailed content of Why did Solana go bankrupt? Is the reason why PI coins are listed on Binance?. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undress AI Tool

Undress images for free

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Clothoff.io

AI clothes remover

Video Face Swap

Swap faces in any video effortlessly with our completely free AI face swap tool!

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Hot Topics

The popularity of the currency circle has returned, why do smart people have begun to quietly increase their positions? Look at the trend from the on-chain data and grasp the next round of wealth password!

Jul 09, 2025 pm 08:30 PM

The popularity of the currency circle has returned, why do smart people have begun to quietly increase their positions? Look at the trend from the on-chain data and grasp the next round of wealth password!

Jul 09, 2025 pm 08:30 PM

As the market conditions pick up, more and more smart investors have begun to quietly increase their positions in the currency circle. Many people are wondering what makes them take decisively when most people wait and see? This article will analyze current trends through on-chain data to help readers understand the logic of smart funds, so as to better grasp the next round of potential wealth growth opportunities.

Crypto Asset Allocation Guide: How to avoid pitfalls and make steady profits in 2025? A low-risk strategy in high volatility, suitable for long-term holders!

Jul 09, 2025 pm 08:36 PM

Crypto Asset Allocation Guide: How to avoid pitfalls and make steady profits in 2025? A low-risk strategy in high volatility, suitable for long-term holders!

Jul 09, 2025 pm 08:36 PM

With the continuous evolution of the crypto market, investors face not only the temptation of high returns, but also the challenge of high risks in 2025. Especially in high volatility market conditions, how to avoid traps and achieve stable returns has become the core issue that long-term holders pay attention to. This article will give a detailed explanation of asset allocation strategies and recommend several low-risk investment methods that are suitable for long-term holding.

Is PEPE coins worth buying? Which PEPE coins will surge in 2025

Jul 11, 2025 pm 10:36 PM

Is PEPE coins worth buying? Which PEPE coins will surge in 2025

Jul 11, 2025 pm 10:36 PM

Whether PEPE coins are worth buying depends on the project's technical background, market performance and ecological construction, and are suitable for investors with strong risk tolerance. 1.PEPE coins are community-driven, with high activity but high volatility; 2. Team technical support and innovation determine long-term development; 3. Trading volume and liquidity affect market experience. PEPE coins that may soar in 2025 include: 1. Projects with rich ecology and clear application scenarios; 2. Projects with hot topics such as NFT and DeFi and strong innovation; 3. Projects with active community and complete governance mechanisms; 4. Projects with cross-chain support and multi-platform listing. Rational judgment and risk control are the key to successful investment.

There are too many slanderous stories in the currency circle? Understand the key logic and risk control secrets in one article!

Jul 09, 2025 pm 08:33 PM

There are too many slanderous stories in the currency circle? Understand the key logic and risk control secrets in one article!

Jul 09, 2025 pm 08:33 PM

The currency circle seems to have a low threshold, but in fact it hides a lot of terms and complex logic. Many novices "rush into the market" in confusion and end up losing money. This article will give a comprehensive explanation of common terms in the currency circle, the operating logic of real money makers, and practical risk control strategies to help readers clarify their ideas and reduce investment risks.

What are the mechanisms for the impact of the BTC halving event on the currency price?

Jul 11, 2025 pm 09:45 PM

What are the mechanisms for the impact of the BTC halving event on the currency price?

Jul 11, 2025 pm 09:45 PM

Bitcoin halving affects the price of currency through four aspects: enhancing scarcity, pushing up production costs, stimulating market psychological expectations and changing supply and demand relationships; 1. Enhanced scarcity: halving reduces the supply of new currency and increases the value of scarcity; 2. Increased production costs: miners' income decreases, and higher coin prices need to maintain operation; 3. Market psychological expectations: Bull market expectations are formed before halving, attracting capital inflows; 4. Change in supply and demand relationship: When demand is stable or growing, supply and demand push up prices.

ETH latest price APP_ETH real-time price update platform entrance

Jul 11, 2025 pm 10:33 PM

ETH latest price APP_ETH real-time price update platform entrance

Jul 11, 2025 pm 10:33 PM

To view the latest price and real-time updates of ETH, you can use the following mainstream platforms: 1. Binance provides real-time price, historical data and market rankings; 2. OKX supports multi-language interface and displays trading volume and market depth; 3. Huobi provides transaction data such as K-line charts and depth charts; 4. Coinbase displays price trends and historical data; 5. Gate.io interface is friendly and suitable for beginners. It is recommended to obtain accurate and secure information through official and well-known platforms to assist investment decisions.

Is NALA coins worth buying? Which cryptocurrencies are worth buying in July

Jul 11, 2025 pm 10:30 PM

Is NALA coins worth buying? Which cryptocurrencies are worth buying in July

Jul 11, 2025 pm 10:30 PM

Whether NALA coins are worth buying requires a comprehensive evaluation of project technology, team strength and market performance. It is suitable for investors with strong risk tolerance in the short term. At the same time, in July, we recommend paying attention to mainstream coins such as Bitcoin, Ethereum and currencies with complete ecosystems with innovative applications. ①NALA currency has strong community support and technological innovation, and the project ecology is gradually improved; ② There may be large fluctuations in the short term, which is suitable for investors with certain risk tolerance; ③ The project team continues to promote the implementation of application scenarios, which is conducive to the stability and growth of currency values; ④ It is necessary to pay attention to the overall market environment and the performance of competitive currency, and formulate investment plans rationally; ⑤ In July, we recommend buying mainstream coins such as Bitcoin (BTC), Ethereum (ETH) and other currencies with mature market foundation and high security;

What are the PEPE coins? PEPE series coins analysis

Jul 11, 2025 pm 10:27 PM

What are the PEPE coins? PEPE series coins analysis

Jul 11, 2025 pm 10:27 PM

PEPE coins include PEPE, PEPECASH, PEPE DAO Token and PEPE NFT Token. 1. PEPE is an original currency, based on emoticon culture, emphasizing community-driven; 2. PEPECASH is used for social payment and content incentives; 3. PEPE DAO Token supports community governance; 4. PEPE NFT Token combines digital art. These coins rely on active communities, but their prices fluctuate greatly and are susceptible to social media. Some projects integrate DeFi and NFT concepts and have innovative potential. When investing, they should comprehensively evaluate the project background and risk tolerance.