Bitcoin Half Chart: Historical Data and Future Trend Analysis

Mar 03, 2025 pm 11:36 PMBitcoin Half: Historical Data, Investment Strategies and Future Outlook

Bitcoin Half, a major event that occurs every four years, has a profound impact on the cryptocurrency market. It cuts block rewards in half, thereby reducing the circulation of new Bitcoins, controlling inflation, and maintaining Bitcoin’s scarcity. On April 20, 2024, the latest halving reduced the block reward from 6.25 bitcoins to 3.125 bitcoins.

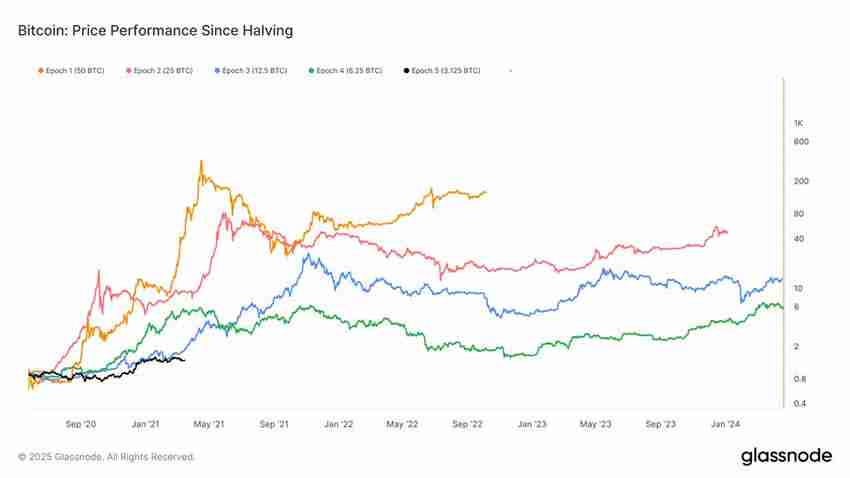

Analysis of historical halving data

Reviewing historical Bitcoin halving, we can find significant patterns in price trends:

- First halving (November 28, 2012): Block rewards were reduced from 50 BTC to 25 BTC, and then the price surged from about $12 to over $1,000 in one year.

- Second Half (July 9, 2016): Block rewards were reduced from 25 BTC to 12.5 BTC, and the price rose from about $650 to nearly $20,000 at the end of 2017.

- Third halving (May 11, 2020): Block rewards were reduced from 12.5 BTC to 6.25 BTC, and Bitcoin broke through the all-time high of $60,000 in 2021.

- The fourth half (April 20, 2024): Block rewards were reduced from 6.25 BTC to 3.125 BTC. Prices were still fluctuating sharply at the beginning of 2025, and the market closely monitored its subsequent performance.

These historical data show that there is a significant correlation between halving events and price increases, fully demonstrating the importance of studying halving charts for investor decision-making.

Use the halving chart to develop an investment strategy

Bitcoin halving chart is a key tool for developing an effective investment strategy. By analyzing the charts, investors can:

- Identify historical trends: Understand price fluctuations after the past halving and predict future trends.

- Evaluate the market cycle: Grasp the cyclical changes in Bitcoin prices and choose the right investment opportunity.

- Assess risk:Analyze the price volatility after halving and effectively manage investment risks.

Future Outlook: 2028 Half Prediction

The next halving is expected to occur around April 2028, and the block reward will further drop to 1.5625 Bitcoins. Investors and analysts will continue to pay attention to this event because its impact on the market cannot be ignored. Keeping abreast of halving chart information and related analysis is crucial to succeed in the turbulent cryptocurrency market.All in all, a deep understanding of the Bitcoin halving chart and mastering the supply mechanisms and potential price trends behind it is the key to investors developing smart strategies in the Bitcoin market. By analyzing historical data and predicting future halving events, investors can be at ease in the challenging cryptocurrency world.

The above is the detailed content of Bitcoin Half Chart: Historical Data and Future Trend Analysis. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undress AI Tool

Undress images for free

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Clothoff.io

AI clothes remover

Video Face Swap

Swap faces in any video effortlessly with our completely free AI face swap tool!

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Hot Topics

OEX official website entrance OEX (Ouyi) platform official registration entrance

Jul 17, 2025 pm 08:42 PM

OEX official website entrance OEX (Ouyi) platform official registration entrance

Jul 17, 2025 pm 08:42 PM

The OEX official website entrance is the primary channel for users to enter the OEX (OEX) platform. The platform is known for its safety, efficiency and convenience, and provides currency trading, contract trading, financial management services, etc. 1. Visit the official website; 2. Click "Register" to fill in your mobile phone number or email address; 3. Set your password and verify; 4. Log in after successful registration. The platform's advantages include high security, simple operation, rich currency, and global service. It also provides beginner's guidance and teaching modules, suitable for all types of investors.

Bitcoin price quote viewing software app to view free quote websites in real time

Jul 17, 2025 pm 06:45 PM

Bitcoin price quote viewing software app to view free quote websites in real time

Jul 17, 2025 pm 06:45 PM

This article recommends 6 mainstream Bitcoin price and market viewing tools. 1. Binance provides real-time and accurate data and rich trading functions, suitable for all kinds of users; 2. OKX has a friendly interface and perfect charts, suitable for technical analysis users; 3. Huobi (HTX) data is stable and reliable, and simple and intuitive; 4. Gate.io has rich currency, suitable for users who track a large number of altcoins at the same time; 5. TradingView aggregates multi-exchange data, with powerful chart and technical analysis functions; 6. CoinMarketCap provides overall market performance data, suitable for understanding the macro market of Bitcoin.

Coinan Exchange Exchange official website Chinese App download. Ranked the top ten.cc

Jul 17, 2025 pm 07:00 PM

Coinan Exchange Exchange official website Chinese App download. Ranked the top ten.cc

Jul 17, 2025 pm 07:00 PM

Binance is an internationally renowned blockchain digital asset trading platform founded by Canadian Chinese engineer Zhao Changpeng, which provides diversified services such as digital currency trading, blockchain education, and project incubation.

How to set stop loss and take profit? Practical skills for risk control of cryptocurrency transactions

Jul 17, 2025 pm 07:09 PM

How to set stop loss and take profit? Practical skills for risk control of cryptocurrency transactions

Jul 17, 2025 pm 07:09 PM

In cryptocurrency trading, stop loss and take profit are the core tools of risk control. 1. Stop loss is used to automatically sell when the price falls to the preset point to prevent the loss from expanding; 2. Take-profit is used to automatically sell when the price rises to the target point and lock in profits; 3. The stop loss can be set using the technical support level method, the fixed percentage method or the volatility reference method; 4. Setting the stop profit can be based on the risk-return ratio method or the key resistance level method; 5. Advanced skills include moving stop loss and batch take-profit to dynamically protect profits and balance risks, thereby achieving long-term and stable trading performance.

Where can I see the Bitcoin market trend? Bitcoin market website recommendation

Jul 17, 2025 pm 09:21 PM

Where can I see the Bitcoin market trend? Bitcoin market website recommendation

Jul 17, 2025 pm 09:21 PM

Understanding Bitcoin’s real-time price trends is crucial to participating in the cryptocurrency market. This will not only help you make smarter investment decisions, but will also allow you to seize market opportunities in a timely manner and avoid potential risks. By analyzing historical data and current trends, you can have a preliminary judgment on the future price direction. This article will recommend some commonly used market analysis websites for you. We will focus on how to use these websites for market analysis to help you better understand the reasons and trends of Bitcoin price fluctuations.

What are the real-time cryptocurrency market websites? Which websites can view the currency market for free?

Jul 17, 2025 pm 09:27 PM

What are the real-time cryptocurrency market websites? Which websites can view the currency market for free?

Jul 17, 2025 pm 09:27 PM

In the currency circle, real-time understanding of currency price changes is crucial to investment decisions. Below are several free and reliable cryptocurrency real-time market websites, suitable for beginners and senior players.

What are the cryptocurrency market websites? Recommended virtual currency market websites

Jul 17, 2025 pm 09:30 PM

What are the cryptocurrency market websites? Recommended virtual currency market websites

Jul 17, 2025 pm 09:30 PM

In the ever-changing virtual currency market, timely and accurate market data is crucial. The free market website provides investors with a convenient way to understand key information such as price fluctuations, trading volume, and market value changes of various digital assets in real time. These platforms usually aggregate data from multiple exchanges, and users can get a comprehensive market overview without switching between exchanges, which greatly reduces the threshold for ordinary investors to obtain information.

Why do experts in the currency circle recommend that novices buy BTC or ETH first?

Jul 17, 2025 pm 10:21 PM

Why do experts in the currency circle recommend that novices buy BTC or ETH first?

Jul 17, 2025 pm 10:21 PM

In the currency circle, many veteran players will recommend that novices start with Bitcoin (BTC) or Ethereum (ETH). This is not a casual statement, but a consensus that has been verified by many years of markets.