web3.0

web3.0

This article explains that the SEC suspends its execution actions against Coinbase and Binance! Completely stop cryptocurrency-related investigations

This article explains that the SEC suspends its execution actions against Coinbase and Binance! Completely stop cryptocurrency-related investigations

This article explains that the SEC suspends its execution actions against Coinbase and Binance! Completely stop cryptocurrency-related investigations

Mar 04, 2025 am 07:03 AM

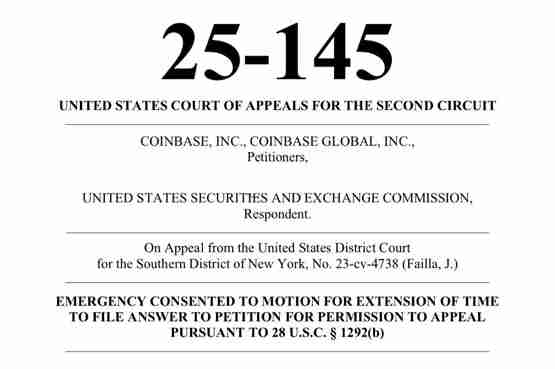

According to former Securities and Exchange Commission official John Reed Stark, the SEC has suspended lawsuits against Coinbase and Binance, and the appeal in the Ripple case is also expected to be suspended. Stark believes that this means that the SEC's enforcement actions on cryptocurrencies may have officially ended.

Behind the SEC's suspension of law enforcement actions

Stark noted that the SEC filed documents with the Second Circuit, claiming that the newly formed cryptocurrency task force could facilitate a settlement with Coinbase and therefore needed to delay response to Coinbase's appeal. The joint motion shows that the SEC is reevaluating its way of regulating cryptocurrencies. Similarly, the SEC also reached an agreement with Binance to suspend enforcement actions against Binance for two months, with the same reasons. These actions all imply that the SEC intends to suspend the crackdown on the crypto industry.

SEC internal changes: cleaning and reorganization?

Stark also mentioned that large-scale adjustments may be underway within the SEC. Jorge Tenreiro, the core lawyer in charge of major cryptocurrency litigation such as Ripple, Coinbase and Binance, has been transferred to the IT department. The move has sparked a lot of speculation, suggesting a major shift in the SEC's cryptocurrency enforcement strategy. At present, these cases have been taken over by the legal team at the SEC headquarters. In addition, the "Cryptocurrency and Cybersecurity Department" has been renamed the "Cyber ??and Emerging Technology Department".

Stark's forecast for SEC's future cryptocurrency policy:

Stark predicts future possibilities of SEC:

- Stop all investigations on cryptocurrencies: Including formal and informal investigations.

- Suspend or accelerated the settlement of all cryptocurrency-related lawsuits: A settlement may be reached on a favorable condition for the defendant.

- Suspend or withdraw all cryptocurrency-related appeals: Including appeals in the Ripple case.

Stark believes that the SEC crypto law enforcement has actually collapsed, and the influence of these judgments has been greatly reduced even if the court has repeatedly ruled that digital assets are securities. Regardless of how the SEC's acting chair or future chairperson explains the suspension of enforcement actions, the SEC's enforcement efforts on cryptocurrencies have been significantly weakened.

The above is the detailed content of This article explains that the SEC suspends its execution actions against Coinbase and Binance! Completely stop cryptocurrency-related investigations. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undress AI Tool

Undress images for free

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Clothoff.io

AI clothes remover

Video Face Swap

Swap faces in any video effortlessly with our completely free AI face swap tool!

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Hot Topics

Is PEPE coins worth buying? Which PEPE coins will surge in 2025

Jul 11, 2025 pm 10:36 PM

Is PEPE coins worth buying? Which PEPE coins will surge in 2025

Jul 11, 2025 pm 10:36 PM

Whether PEPE coins are worth buying depends on the project's technical background, market performance and ecological construction, and are suitable for investors with strong risk tolerance. 1.PEPE coins are community-driven, with high activity but high volatility; 2. Team technical support and innovation determine long-term development; 3. Trading volume and liquidity affect market experience. PEPE coins that may soar in 2025 include: 1. Projects with rich ecology and clear application scenarios; 2. Projects with hot topics such as NFT and DeFi and strong innovation; 3. Projects with active community and complete governance mechanisms; 4. Projects with cross-chain support and multi-platform listing. Rational judgment and risk control are the key to successful investment.

What are the mechanisms for the impact of the BTC halving event on the currency price?

Jul 11, 2025 pm 09:45 PM

What are the mechanisms for the impact of the BTC halving event on the currency price?

Jul 11, 2025 pm 09:45 PM

Bitcoin halving affects the price of currency through four aspects: enhancing scarcity, pushing up production costs, stimulating market psychological expectations and changing supply and demand relationships; 1. Enhanced scarcity: halving reduces the supply of new currency and increases the value of scarcity; 2. Increased production costs: miners' income decreases, and higher coin prices need to maintain operation; 3. Market psychological expectations: Bull market expectations are formed before halving, attracting capital inflows; 4. Change in supply and demand relationship: When demand is stable or growing, supply and demand push up prices.

ETH latest price APP_ETH real-time price update platform entrance

Jul 11, 2025 pm 10:33 PM

ETH latest price APP_ETH real-time price update platform entrance

Jul 11, 2025 pm 10:33 PM

To view the latest price and real-time updates of ETH, you can use the following mainstream platforms: 1. Binance provides real-time price, historical data and market rankings; 2. OKX supports multi-language interface and displays trading volume and market depth; 3. Huobi provides transaction data such as K-line charts and depth charts; 4. Coinbase displays price trends and historical data; 5. Gate.io interface is friendly and suitable for beginners. It is recommended to obtain accurate and secure information through official and well-known platforms to assist investment decisions.

Which virtual currency platform is legal? What is the relationship between virtual currency platforms and investors?

Jul 11, 2025 pm 09:36 PM

Which virtual currency platform is legal? What is the relationship between virtual currency platforms and investors?

Jul 11, 2025 pm 09:36 PM

There is no legal virtual currency platform in mainland China. 1. According to the notice issued by the People's Bank of China and other departments, all business activities related to virtual currency in the country are illegal; 2. Users should pay attention to the compliance and reliability of the platform, such as holding a mainstream national regulatory license, having a strong security technology and risk control system, an open and transparent operation history, a clear asset reserve certificate and a good market reputation; 3. The relationship between the user and the platform is between the service provider and the user, and based on the user agreement, it clarifies the rights and obligations of both parties, fee standards, risk warnings, account management and dispute resolution methods; 4. The platform mainly plays the role of a transaction matcher, asset custodian and information service provider, and does not assume investment responsibilities; 5. Be sure to read the user agreement carefully before using the platform to enhance yourself

Is NALA coins worth buying? Which cryptocurrencies are worth buying in July

Jul 11, 2025 pm 10:30 PM

Is NALA coins worth buying? Which cryptocurrencies are worth buying in July

Jul 11, 2025 pm 10:30 PM

Whether NALA coins are worth buying requires a comprehensive evaluation of project technology, team strength and market performance. It is suitable for investors with strong risk tolerance in the short term. At the same time, in July, we recommend paying attention to mainstream coins such as Bitcoin, Ethereum and currencies with complete ecosystems with innovative applications. ①NALA currency has strong community support and technological innovation, and the project ecology is gradually improved; ② There may be large fluctuations in the short term, which is suitable for investors with certain risk tolerance; ③ The project team continues to promote the implementation of application scenarios, which is conducive to the stability and growth of currency values; ④ It is necessary to pay attention to the overall market environment and the performance of competitive currency, and formulate investment plans rationally; ⑤ In July, we recommend buying mainstream coins such as Bitcoin (BTC), Ethereum (ETH) and other currencies with mature market foundation and high security;

What are the PEPE coins? PEPE series coins analysis

Jul 11, 2025 pm 10:27 PM

What are the PEPE coins? PEPE series coins analysis

Jul 11, 2025 pm 10:27 PM

PEPE coins include PEPE, PEPECASH, PEPE DAO Token and PEPE NFT Token. 1. PEPE is an original currency, based on emoticon culture, emphasizing community-driven; 2. PEPECASH is used for social payment and content incentives; 3. PEPE DAO Token supports community governance; 4. PEPE NFT Token combines digital art. These coins rely on active communities, but their prices fluctuate greatly and are susceptible to social media. Some projects integrate DeFi and NFT concepts and have innovative potential. When investing, they should comprehensively evaluate the project background and risk tolerance.

What are the mainstream public chains of cryptocurrencies? The top ten rankings of cryptocurrency mainstream public chains in 2025

Jul 10, 2025 pm 08:21 PM

What are the mainstream public chains of cryptocurrencies? The top ten rankings of cryptocurrency mainstream public chains in 2025

Jul 10, 2025 pm 08:21 PM

The pattern in the public chain field shows a trend of "one super, many strong ones, and a hundred flowers blooming". Ethereum is still leading with its ecological moat, while Solana, Avalanche and others are challenging performance. Meanwhile, Polkadot, Cosmos, which focuses on interoperability, and Chainlink, which is a critical infrastructure, form a future picture of multiple chains coexisting. For users and developers, choosing which platform is no longer a single choice, but requires a trade-off between performance, cost, security and ecological maturity based on specific needs.

BTC price trend analysis: What indicators should be taken for the rise and fall in the future (2026-2030)?

Jul 10, 2025 pm 09:06 PM

BTC price trend analysis: What indicators should be taken for the rise and fall in the future (2026-2030)?

Jul 10, 2025 pm 09:06 PM

Bitcoin’s long-term price trend between 2026 and 2030 will be mainly affected by four core factors. 1. Global macro liquidity, especially Fed interest rate policy, inflation data and economic growth expectations, a loose environment is usually beneficial to BTC; 2. The reduction in supply and market expectations brought about by the halving cycle in 2028 may drive price increases; 3. The clarification of the regulatory framework, especially the introduction of compliance paths and approval of financial products in major economies, is the basis of a long-term bull market; 4. The depth and breadth of institutional adoption, including corporate asset allocation, financial institution service expansion and payment application progress, marks the transition of BTC to mainstream assets; in addition, technological developments such as the maturity of Lightning networks and network security status will also support its value.