How to buy Bitcoin on Alipay? Alipay Buy BTC Complete Tutorial

Mar 05, 2025 pm 06:03 PMAlipay and Bitcoin Transactions: A Safe and Convenient Buying Guide

As a widely used payment tool in China, Alipay does not support direct purchase of cryptocurrencies such as Bitcoin, you can complete transactions indirectly through some channels. This article will guide you on how to use Alipay to purchase Bitcoin safely and conveniently, and explain the risks that need to be paid attention to.

Purchase Bitcoin indirectly through cryptocurrency exchange

The most common way at present is to trade through cryptocurrency exchanges that support Alipay. This method usually requires you to buy USDT (stablecoin) first and then exchange USDT for Bitcoin. The following is a detailed description of the operation steps using Ouyi OKX Exchange as an example:

- Register Ouyi OKX account: Access Ouyi OKX official website (click to register), register an account with your email address, and complete email verification and mobile phone number verification.

- Complete identity authentication: After logging in to the account, go to the "User Center" to perform identity authentication to improve account security and transaction limits.

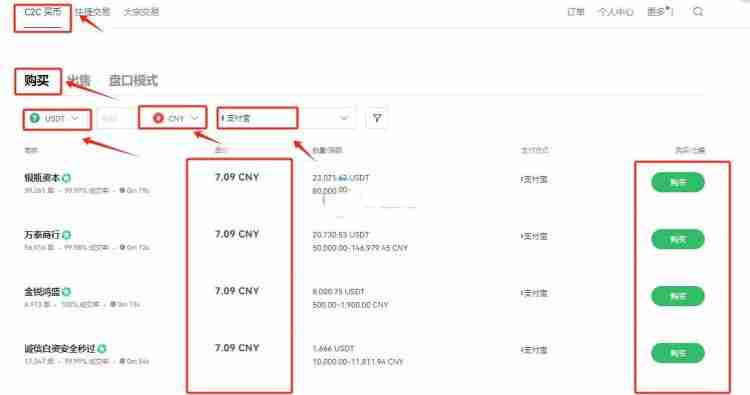

- Use Alipay to purchase USDT: In the C2C trading area of ??Ouyi OKX, choose Alipay as the payment method and choose the appropriate merchant to purchase USDT. After completing the payment, wait for the merchant to release the coins.

- Convert USDT to Bitcoin: On the "Coin Trading" page of Ouyi OKX, select the BTC/USDT trading pair, enter the amount of Bitcoin you want to buy, and click "Buy".

Risk warning

Although buying Bitcoin through an exchange is relatively convenient, please be sure to pay attention to the following risks:

- Alipay Risk: Alipay is prohibited from being used for virtual currency transactions. Using Alipay to purchase Bitcoin may cause the account to be restricted or frozen.

- Legal risks: In China, there are legal risks in virtual currency transactions, so be cautious when participating in transactions.

- Market risk: Bitcoin price fluctuates violently, and investment is risky.

- Platform Risk: Trading Platform may face hacking or system failure, resulting in loss of funds.

Suggestions

To reduce risks, we recommend you:

- Choose a reputable, secure and reliable cryptocurrency exchange.

- Understand the risks of Bitcoin trading and invest with caution.

- Try to avoid using Alipay for virtual currency transactions, and it is recommended to use bank cards and other payment methods.

- Keep paying attention to market trends and do a good job in risk management.

This article is for reference only and does not constitute any investment advice. Always conduct adequate research and risk assessment before making any investment.

The above is the detailed content of How to buy Bitcoin on Alipay? Alipay Buy BTC Complete Tutorial. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undress AI Tool

Undress images for free

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Clothoff.io

AI clothes remover

Video Face Swap

Swap faces in any video effortlessly with our completely free AI face swap tool!

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Hot Topics

LayerZero, StarkNet, ZK Ecological Preheat: How long can the airdrop bonus last?

Jul 16, 2025 am 10:06 AM

LayerZero, StarkNet, ZK Ecological Preheat: How long can the airdrop bonus last?

Jul 16, 2025 am 10:06 AM

The duration of the airdrop dividend is uncertain, but the LayerZero, StarkNet and ZK ecosystems still have long-term value. 1. LayerZero achieves cross-chain interoperability through lightweight protocols; 2. StarkNet provides efficient and low-cost Ethereum L2 expansion solutions based on ZK-STARKs technology; 3. ZK ecosystem (such as zkSync, Scroll, etc.) expands the application of zero-knowledge proof in scaling and privacy protection; 4. Participation methods include the use of bridging tools, interactive DApps, participating test networks, pledged assets, etc., aiming to experience the next generation of blockchain infrastructure in advance and strive for potential airdrop opportunities.

The flow of funds on the chain is exposed: What new tokens are being bet on by Clever Money?

Jul 16, 2025 am 10:15 AM

The flow of funds on the chain is exposed: What new tokens are being bet on by Clever Money?

Jul 16, 2025 am 10:15 AM

Ordinary investors can discover potential tokens by tracking "smart money", which are high-profit addresses, and paying attention to their trends can provide leading indicators. 1. Use tools such as Nansen and Arkham Intelligence to analyze the data on the chain to view the buying and holdings of smart money; 2. Use Dune Analytics to obtain community-created dashboards to monitor the flow of funds; 3. Follow platforms such as Lookonchain to obtain real-time intelligence. Recently, Cangming Money is planning to re-polize LRT track, DePIN project, modular ecosystem and RWA protocol. For example, a certain LRT protocol has obtained a large amount of early deposits, a certain DePIN project has been accumulated continuously, a certain game public chain has been supported by the industry treasury, and a certain RWA protocol has attracted institutions to enter.

Ethereum, EigenLayer, Restaking narrative upgrades again: capital pours into new highlands

Jul 16, 2025 am 10:12 AM

Ethereum, EigenLayer, Restaking narrative upgrades again: capital pours into new highlands

Jul 16, 2025 am 10:12 AM

The Restaking project is becoming a new hot spot in the Ethereum ecosystem. This article lists the top ten projects that are worth paying attention to and their core indicators. 1. EigenLayer: core protocol, supports AVS expansion, attracting more than US$10 billion in pledged assets; 2. Ethos: modular security market, supports multiple link entry; 3. Karak: user experience is preferred, providing one-click pledge process; 4. Symbiotic: open security protocol, compatible with multiple pledged assets; 5. Bunker Finance: applied in the DeFi risk control field; 6. ZeroLayer: focusing on infrastructure verification; 7. Lava Protocol: focusing on RPC

Pre-sales of Filecoin, Render, and AI storage are heating up: Is the explosion point of Web3 infrastructure coming?

Jul 16, 2025 am 09:51 AM

Pre-sales of Filecoin, Render, and AI storage are heating up: Is the explosion point of Web3 infrastructure coming?

Jul 16, 2025 am 09:51 AM

Yes, Web3 infrastructure is exploding expectations as demand for AI heats up. Filecoin integrates computing power through the "Compute over Data" plan to support AI data processing and training; Render Network provides distributed GPU computing power to serve AIGC graph rendering; Arweave supports AI model weights and data traceability with permanent storage characteristics; the three are combining technology upgrades and ecological capital promotion, and are moving from the edge to the underlying core of AI.

Bitcoin, Chainlink, and RWA resonance rise: crypto market enters institutional logic?

Jul 16, 2025 am 10:03 AM

Bitcoin, Chainlink, and RWA resonance rise: crypto market enters institutional logic?

Jul 16, 2025 am 10:03 AM

The coordinated rise of Bitcoin, Chainlink and RWA marks the shift toward institutional narrative dominance in the crypto market. Bitcoin, as a macro hedging asset allocated by institutions, provides a stable foundation for the market; Chainlink has become a key bridge connecting the reality and the digital world through oracle and cross-chain technology; RWA provides a compliance path for traditional capital entry. The three jointly built a complete logical closed loop of institutional entry: 1) allocate BTC to stabilize the balance sheet; 2) expand on-chain asset management through RWA; 3) rely on Chainlink to build underlying infrastructure, indicating that the market has entered a new stage driven by real demand.

Dogecoin, Pepe, Brett swept the meme track: speculation or new narrative?

Jul 16, 2025 am 09:57 AM

Dogecoin, Pepe, Brett swept the meme track: speculation or new narrative?

Jul 16, 2025 am 09:57 AM

Dogecoin, Pepe and Brett are leading the meme coin craze. Dogecoin (DOGE) is the originator, firmly ranked first in the market value list, Pepe (PEPE) has achieved hundreds of times increase with its social geek culture, and Brett (BRETT) has become popular with its unique visual style as a new star in Base chain; the three were issued in 2013, 2023 and 2024 respectively. Technically, Dogecoin is based on Litecoin, Pepe and Brett are ERC-20 tokens, and the latter relies on the Base chain to improve efficiency. In terms of community, DOGE Twitter fans have exceeded 3 million, Pepe Reddit is leading in activity, Brett's popularity in Base chain, and DOGE has logged in on the platform.

Crypto market value exceeds US$3 trillion: Which sectors are funds betting on?

Jul 16, 2025 am 09:45 AM

Crypto market value exceeds US$3 trillion: Which sectors are funds betting on?

Jul 16, 2025 am 09:45 AM

Crypto market value exceeded US$3 trillion, and funds mainly bet on seven major sectors. 1. Artificial Intelligence (AI) Blockchain: Popular currencies include FET, RNDR, AGIX, Binance and OKX launch related trading pairs and activities, funds bet on AI and decentralized computing power and data integration; 2. Layer2 and modular blockchain: ARB, OP, ZK series, TIA are attracting attention, HTX launches modular assets and provides commission rebates, funds are optimistic about their support for DeFi and GameFi; 3. RWA (real world assets): ONDO, POLYX, XDC and other related assets, OKX adds an RWA zone, and funds are expected to migrate on traditional financial chains; 4. Public chain and platform coins: SOL, BNB, HT, OKB are strong

Changes in the flow of on-chain funds: What tracks are new funds pouring into?

Jul 16, 2025 am 09:42 AM

Changes in the flow of on-chain funds: What tracks are new funds pouring into?

Jul 16, 2025 am 09:42 AM

The most popular tracks for new funds currently include re-staking ecosystems, integration of AI and Crypto, revival of the Bitcoin ecosystem and DePIN. 1) The re-staking protocol represented by EigenLayer improves capital efficiency and absorbs a large amount of long-term capital; 2) The combination of AI and blockchain has spawned decentralized computing power and data projects such as Render, Akash, Fetch.ai, etc.; 3) The Bitcoin ecosystem expands application scenarios through Ordinals, BRC-20 and Runes protocols to activate silent funds; 4) DePIN builds a realistic infrastructure through token incentives to attract the attention of industrial capital.