web3.0

web3.0

What are TWAP and VWAP? What is the difference between TWAP and VWAP in cryptocurrency trading?

What are TWAP and VWAP? What is the difference between TWAP and VWAP in cryptocurrency trading?

What are TWAP and VWAP? What is the difference between TWAP and VWAP in cryptocurrency trading?

May 15, 2025 am 10:42 AMTable of contents

- What is the time-weighted average price (TWAP)?

- How to calculate TWAP

- What is Volume Weighted Average Price (VWAP)

- How to calculate VWAP

- When to use TWAP and VWAP?

- TWAP and VWAP: Understanding the core differences between two major algorithmic trading strategies

- TWAP and VWAP in cryptocurrency trading

With the development of the cryptocurrency market, algorithmic trading has become the core strategic choice for many professional traders. This trading method automatically executes trading instructions based on specific rules, completely eliminating the factors of artificial emotional interference and indecision, and relying solely on pure logical operations. This type of system can monitor market dynamics 24 hours a day, respond instantly to price fluctuations, and handle massive orders at a speed far exceeding human operation.

Mainstream algorithmic trading strategies mainly include:

- Trend tracking: Trading layout based on the momentum of the market rise or fall.

- Arbitrage trading: Make full use of price differences between different trading platforms.

- Market maker strategy: Get profits from the bid and offer spread by placing a buy and sell order at the same time.

- Mean regression: Trading based on the theory that the price will eventually revert to the mean.

In the field of algorithmic trading, there is a specialized execution algorithm. These algorithms do not focus on market direction prediction, but focus on how to establish or close large-scale trading positions without significantly affecting market prices. Such algorithms play a particularly important role in handling large-scale orders.

Among many execution strategies, passive order execution strategies have attracted much attention. Such strategies are committed to minimizing slippage and as close to a reasonable average transaction price as possible. Two of the core concepts are:

- Time-weighted average price (TWAP): Split the order evenly according to the time dimension, regardless of market transaction volume factors. This strategy is especially suitable for market environments with insufficient liquidity or scenarios where low-key positions are required.

- Volume Weighted Average Price (VWAP): Dynamically adjust the transaction scale based on real-time market trading volume, and execute large-scale transactions during periods of high market activity.

Both strategies can effectively avoid severe market fluctuations and are an indispensable professional tool for today's cryptocurrency traders.

What is the time-weighted average price (TWAP)?

TWAP (Time-weighted Average Price) as an algorithmic trading strategy has become one of the most basic and widely used execution strategies in the cryptocurrency market.

The core advantage of this strategy is that it can assist traders in breaking down large-value trading orders into several small-value trading and achieving equilibrium execution within a specific time period, which is not affected by fluctuations in market trading volume. TWAP aims to obtain an average price based on time dimensions rather than market activities, while effectively avoiding severe price fluctuations caused by large transactions.

The TWAP strategy shows outstanding advantages in the following two scenarios: First, it is necessary to keep a low profile when executing large-scale transactions to avoid attracting market attention; second, it is to trade in an environment where market liquidity is insufficient, because in this case, even moderate-scale orders may cause price fluctuations. By scientifically allocating transaction execution time, TWAP can effectively reduce slippage risks and ensure that trading behavior is not noticed by the market.

The most significant advantage of TWAP is its simplicity of operation - it is easy to implement and understand and master. However, this simplicity also means a certain limitation: the TWAP strategy does not take into account market trading volume factors. Therefore, when the market fluctuates violently or changes suddenly, this strategy may ignore important market signals, resulting in the execution price not being able to accurately reflect the current market conditions.

Overall, TWAP is a high-quality strategic choice for scenarios where continuous and stable trading is required, especially when the market is relatively stable. But if traders pay more attention to trading volume and market volatility, this strategy may not always provide the best trading results.

Did you know? Investors can easily enable TWAP indicators on mainstream trading platforms such as TradingView. The specific operation method is: open the trading chart, select the "Indicator" option, and then enter "TWAP" in the search bar.

How to calculate TWAP

To calculate the time-weighted average price (TWAP), you need to collect asset prices regularly, accumulate all collected price data, and divide it by the total number of times the price is collected to get the result.

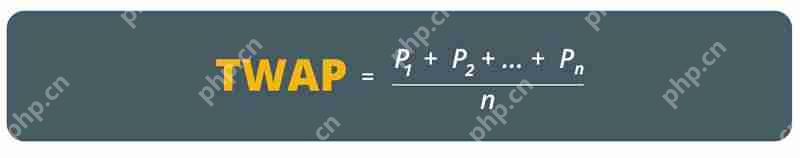

Here are the standard formulas for calculating TWAP:

Describe it in a more intuitive way, the specific calculation formula is as follows:

TWAP = (Price ? Price ? ... Price ?) / n

Let's analyze it through a real case.

Suppose we monitor the market price of Bitcoin (BTC) at 10 minutes intervals and obtain the following data:

$90,000 → $90,100 → $89,900 → $90,050

Add these price data:

$90,000 $90,100 $89,900 $90,050 = $360,050

Finally divide the sum by the number of samples (4 times):

TWAP = 360050 ÷ 4 = $90012.5

What is Volume Weighted Average Price (VWAP)

VWAP (Trading Volume Weighted Average Price) has become an important tool for professional traders to gain insight into the real market value of assets.

Compared with TWAP (time-weighted average price) calculated simply based on the time dimension, VWAP is unique in incorporating transaction volume into the calculation dimension. This method allows the price of high trading volume periods to gain greater weight in the final mean, thus more accurately reflecting the actual pricing level of the market for assets.

Market participants generally regard VWAP as an important reference benchmark for trading decisions. When the trading price is below VWAP, investors may get an entry opportunity that is better than the market average. At the same time, VWAP can also be used for trend judgment - current price higher than VWAP may indicate a bullish trend, and vice versa may imply a bearish market.

VWAP has significant advantages: it not only provides a more accurate reference to market value, but also helps identify the overbought or oversold status of assets. However, this indicator also has certain limitations. The calculation process is relatively complex and may be disturbed by large-scale abnormal transactions, resulting in deviations in the mean.

Overall, VWAP is a powerful market analysis tool, especially suitable for professional traders who study market dynamics in depth. But like other technical indicators, it is recommended to use it in conjunction with other analytical tools for more comprehensive market insights.

Did you know? The term VWAP first appeared in the Journal of Finance published in March 1988, titled "Total Cost of NYSE Transactions", written by Stephen Berkowitz, Dennis Logue and Eugene Noser Jr. This paper proposes for the first time VWAP is used as a benchmark indicator for evaluating the efficiency of transaction execution of institutional investors.

How to calculate VWAP

As an important trading indicator, VWAP (volume-weighted average price) is unique in that it uses differentiated weights for different price points, that is, allocating the weight coefficient according to the size of the trading volume.

Here are the standard formulas for calculating VWAP:

In a concise expression, the calculation formula is:

VWAP = (prices of each price point × sum of corresponding transaction volumes) ÷ cumulative total transaction volume

Let's explain in detail through an actual transaction case.

Suppose we have the following transaction data for Bitcoin (BTC):

- 90,000 USD corresponds to 10 transactions

- 90,100 USD corresponds to 20 transactions

- 5 transactions for USD 89,900

- 90,050 USD corresponds to 15 transactions

The first step is to calculate the weighted value of each price point:

- 90000 × 10 = 900000

- 90100 × 20 = 1802000

- 89900 × 5 = 449500

- 90050 × 15 = 1350750

The second step is to calculate the sum of weighted values:

900000 1802000 449500 1350750 = 4502250

Step 3: count the total number of transactions:

10 20 5 15 = 50

Finally, the VWAP value is obtained:

VWAP = 4502250 ÷ 50 = 90045

When to use TWAP and VWAP?

The answer to this question mainly depends on the type of transaction you choose and the market environment at that time.

During active market trading, if you want to ensure that the trading price is consistent with the mainstream market price and avoid premiums or price deviations, VWAP (volume weighted average price) will be an ideal reference indicator. By integrating trading volume factors, this indicator can more accurately reflect the "actual" average price level of the market, which makes it an effective tool to evaluate trading performance and grasp the timing of market entry. When your buying price is below VWAP, it often means you have completed a better deal.

In contrast, TWAP (Time Weighted Average Price) is more suitable for scenarios that require careful operation. For example, when dealing with digital currencies with limited liquidity, or when trading during light market periods, due to large fluctuations in trading volume, TWAP can help you gradually build or reduce positions to avoid market fluctuations. This indicator does not take into account the trading volume factor, but distributes the transaction evenly within a specific time period.

Conclusion: If you expect to grasp the overall market trend and achieve accurate trading, it is recommended to choose the VWAP indicator. If you tend to operate resiliently and pursue simple and effective strategies, TWAP will be the more appropriate choice.

TWAP and VWAP: Understanding the core differences between two major algorithmic trading strategies

TWAP and VWAP in cryptocurrency trading

Professional trading institutions and investors usually use TWAP and VWAP strategies to reduce market shock costs to obtain a more ideal execution price.

Let us analyze the application effect of these algorithms in critical periods through two practical cases.

1. Strategy uses TWAP to implement a $2.5 billion Bitcoin (BTC) procurement plan

In August 2020, Strategy (formerly known as MicroStrategy) issued a major announcement, planning to invest US$2.5 billion to purchase Bitcoin (BTC) as a reserve asset, which caused a huge response in the market. In order to avoid the sharp price fluctuations that may be caused by a single large-scale transaction, the company has launched a strategic cooperation with the Coinbase trading platform to implement transactions using the TWAP strategy.

By spreading the purchase demand to completion for several days, Strategy successfully integrates transactions into the market's natural liquidity, effectively controlling price slippage, and ensuring a relatively ideal average transaction price.

2. Definitive TWAP policy case for Instadapp (INST)

A well-known cryptocurrency investment institution chose the TWAP strategy when dealing with Instadapp (INST), a decentralized financial token with relatively limited liquidity. The agency used Definitive's TWAP algorithm in July 2024 to complete transactions in batches within two weeks.

The final data shows that compared with the VWAP solution, the strategy saves transaction costs by 7.5%, while gas fees account for only 0.30% of the total order of US$666,000. From the perspective of transaction cost-effectiveness and execution concealment, this is undoubtedly a successful strategy application.

3. VWAP application practice of Kraken Pro platform

Kraken Exchange integrates VWAP as one of the core technical indicators in its professional version of the platform Kraken Pro. Thanks to the technical support of TradingView, users can intuitively view VWAP data for different time periods in the trading interface for encrypted asset analysis.

For example, traders in Kraken Pro can use VWAP to optimize Bitcoin (BTC) trading strategies. When the BTC price is below the daily VWAP - which means the current trading price is below the volume weighted average, there may be an undervalue - buy at the right time and choose to sell when the price rises - indicating that there may be an overvalue or a profit opportunity arises.

Kraken's VWAP feature is particularly popular with institutional clients and large-value traders, helping them achieve precise trading in the ever-changing crypto market.

For traders who are interested in establishing a dominant position in the market, it is crucial to understand the timing and methods of TWAP and VWAP application, whether it is managing large orders or seeking reasonable market entry points.

The above is the detailed content of What are TWAP and VWAP? What is the difference between TWAP and VWAP in cryptocurrency trading?. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undress AI Tool

Undress images for free

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Clothoff.io

AI clothes remover

Video Face Swap

Swap faces in any video effortlessly with our completely free AI face swap tool!

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Hot Topics

1794

1794

16

16

1739

1739

56

56

1590

1590

29

29

1468

1468

72

72

267

267

587

587

MBG Token Release: MultiBank Group Takes a Bold Step toward the Future of Finance

Jul 25, 2025 am 07:51 AM

MBG Token Release: MultiBank Group Takes a Bold Step toward the Future of Finance

Jul 25, 2025 am 07:51 AM

The MBG token launched by MultiBank Group is attracting widespread attention. With its efficient pre-sale performance and successful launch, it has successfully opened up the barriers between traditional finance and blockchain technology. MBG tokens have become a hot topic in the financial circle. After all sold out in just a few minutes during the pre-sale stage, the token officially entered the market for circulation on July 22, 2025. This action not only has great significance to the MultiBank Group, but also brings new imagination space to the entire crypto ecosystem. Next, let’s take a look at what’s special about MBG. Why does MBG attract attention? It is not an ordinary crypto asset, but a digital voucher that anchors real value. Relying on MultiBank Group Daily Gundam

What is Useless Coin? Overview of USELESS currency usage, outstanding features and future growth potential

Jul 24, 2025 pm 11:54 PM

What is Useless Coin? Overview of USELESS currency usage, outstanding features and future growth potential

Jul 24, 2025 pm 11:54 PM

What are the key points of the catalog? UselessCoin: Overview and Key Features of USELESS The main features of USELESS UselessCoin (USELESS) Future price outlook: What impacts the price of UselessCoin in 2025 and beyond? Future Price Outlook Core Functions and Importances of UselessCoin (USELESS) How UselessCoin (USELESS) Works and What Its Benefits How UselessCoin Works Major Advantages About USELESSCoin's Companies Partnerships How they work together

What is PFVS coin? What is the value in the future and is there any prospects? Analysis of PFVS Coin Price Trend

Jul 24, 2025 pm 11:48 PM

What is PFVS coin? What is the value in the future and is there any prospects? Analysis of PFVS Coin Price Trend

Jul 24, 2025 pm 11:48 PM

Directory What is the Puffverse(PFVS) currency? What is the future value of PFVS coins? Does PFVS coins have any prospects? PFVS token Economics and Distribution 1. Total Supply and Distribution Structure 2. Community-centric Distribution 3. Sustainable Attribution Timeline 4. Economic Sustainability Mechanism 5. Team Allocation and Destruction Commitment Functions of PFVS Coin 1. Main Utility and Game Integration 2. Participate in Governance through vePUFF Conversion 3. Pledge Rewards and Revenue Sharing 4. Economic Incentives and Creator Rewards 5. Destruction and Deflation Mechanism Summary PFVS Coin is the native token of Puffverse, and its main function is payment and rewards

Cardano Ecological Observation: Can PayFi token Remittix trigger ADA transcendence?

Jul 25, 2025 am 07:57 AM

Cardano Ecological Observation: Can PayFi token Remittix trigger ADA transcendence?

Jul 25, 2025 am 07:57 AM

As a PayFi token, is Remittix (RTX) ready to shake the Cardano ecosystem and challenge the core position of ADA? Let's take a deeper analysis of key trends and forward-looking insights that are reshaping the DeFi landscape. Entering 2025, the Cardano ecosystem has shown vigorous vitality, but an emerging force, Remittix (RTX), has risen strongly on the PayFi track, which may pose a substantial threat to ADA's dominance. Is a drama about a counterattack in market value about to happen? Cardano's steady path forward Cardano has long established its benchmark image of green blockchain, and has developed steadily based on the energy-saving proof of stake (PoS) mechanism and its increasingly enhanced scalability. Hydra

Ethereum price trend k-line app Ethereum today's real-time market chart view

Jul 24, 2025 pm 11:18 PM

Ethereum price trend k-line app Ethereum today's real-time market chart view

Jul 24, 2025 pm 11:18 PM

Ethereum is a decentralized open source platform based on blockchain technology. It allows developers to build and deploy smart contracts and decentralized applications. Ethereum (ETH) is a native cryptocurrency of the Ethereum platform and is one of the leading digital assets with market capitalization.

What is Goldfinch Crypto (GFI Coin)? GFI Token Price Forecast 2025-2030

Jul 24, 2025 pm 11:39 PM

What is Goldfinch Crypto (GFI Coin)? GFI Token Price Forecast 2025-2030

Jul 24, 2025 pm 11:39 PM

Table of Contents What is Goldfinch (GFI)? The working principle of Goldfinch (GFI) builds trust through consensus and borrower repayment incentives for participants through consensus, and innovates governance protocol mechanism, breaking through the dilemma of over-mortgage GFI tokens: Core market performance and latest dynamic price forecasts: Growth potential in differences Short-term (2025) Medium (2027-2028) Long-term (2030) Core advantages and potential risks Differentiated competitiveness risk Warning of future prospects As a decentralized credit protocol, it solves the long-standing core contradictions in the DeFi field: how to achieve safe and capable without relying on crypto assets to be mortgaged.

BNB Coin hits a new high: breaking through $800, what is the driving force behind it? BNB Coin price forecast and future prospect analysis

Jul 24, 2025 pm 11:45 PM

BNB Coin hits a new high: breaking through $800, what is the driving force behind it? BNB Coin price forecast and future prospect analysis

Jul 24, 2025 pm 11:45 PM

Table of Contents BNB briefly introduces the main driving force for BNB price hitting a new high BNB soaring BNB price forecast 2026 BNB price forecast 2030 BNB price forecast 2040 BNB price forecast 2050 BNB price forecast Challenge and outlook around 8:30 am on the 23rd, Binance Coin (BNB) price successfully broke through the psychological threshold of US$800, setting a new record after more than seven months. The top $800 this time reflects a significant recovery in market sentiment. Against the backdrop of continuous capital inflows, BNB is entering a new round of price exploration. Analysts pointed out that if BNB can stabilize above the previous high of $793, it is expected to continue to expand its space upward in the future. But it should be noted that

PHP integrated AI intelligent picture recognition PHP visual content automatic labeling

Jul 25, 2025 pm 05:42 PM

PHP integrated AI intelligent picture recognition PHP visual content automatic labeling

Jul 25, 2025 pm 05:42 PM

The core idea of integrating AI visual understanding capabilities into PHP applications is to use the third-party AI visual service API, which is responsible for uploading images, sending requests, receiving and parsing JSON results, and storing tags into the database; 2. Automatic image tagging can significantly improve efficiency, enhance content searchability, optimize management and recommendation, and change visual content from "dead data" to "live data"; 3. Selecting AI services requires comprehensive judgments based on functional matching, accuracy, cost, ease of use, regional delay and data compliance, and it is recommended to start from general services such as Google CloudVision; 4. Common challenges include network timeout, key security, error processing, image format limitation, cost control, asynchronous processing requirements and AI recognition accuracy issues.