CryptoQuant CEO Ki Young Ju: Note that the altcoin season has begun

Mar 04, 2025 am 09:18 AMCryptoQuant CEO Ki Young Ju announced: The altcoin season has begun! However, this market trend is very different from the past, how should investors deal with it?

Ki Young Ju: What's unique about this altcoin season

Bitcoin dominance is no longer a decisive factor

Traditionally, the start of the altcoin season is closely related to the decline in Bitcoin (BTC) market share. But Ki Young Ju pointed out that Bitcoin’s market share is no longer a key indicator, and the real driver is trading volume.

His observation results:

- The transaction volume of altcoin has reached 2.7 times that of Bitcoin, indicating that a large amount of funds are pouring into the altcoin market.

- Stablecoin holders invest directly in altcoins instead of transferring funds through Bitcoin, which is very different from previous trends.

- This altcoin season is "selective", and only altcoins with strong application scenarios and market narratives can stand out.

- Investors should conduct independent research (DYOR) to avoid blindly following the trend.

These views show that market capital flows are undergoing significant changes and investors need to re-examine their trading strategies.

Current Market Status: Does the data support a surge in altcoin trading volume?

Latest Market Data (February 21, 2025)

According to CoinGecko data, the current key market data are as follows:

It should be noted that although the altcoin transaction volume does exceed Bitcoin, the data shows that its proportion is 2.1 times, not 2.7 times as mentioned by Ki Young Ju. This may be due to differences in data sources, calculation methods, or specific time ranges from different exchanges.

Stablecoins become a source of funds, subverting the traditional market model

The traditional capital circulation model has been broken

Previous altcoin seasons were usually driven by bitcoin funds flowing into altcoins, that is, investors first exchange BTC for altcoins. However, this market showed a different trend:

- Stablecoins (such as USDT, USDC) funds flow directly into the altcoin market, rather than being transferred through Bitcoin.

- This means that the altcoin market has gained a new source of funding independent of BTC and no longer relies on the decline in Bitcoin market share to drive growth.

Currently, the total market value of the stablecoin market is approximately US$233 billion (CoinGecko data), which provides strong liquidity for the market and also allows investors to trade more flexibly.

This is consistent with the views discussed in January 2025, when Ki Young Ju pointed out: "The altcoin market is a zero-sum game, with limited overall liquidity." This means that not all altcoins can benefit from this wave of capital inflows, and only specific projects can perform well.

The above is the detailed content of CryptoQuant CEO Ki Young Ju: Note that the altcoin season has begun. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undress AI Tool

Undress images for free

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Clothoff.io

AI clothes remover

Video Face Swap

Swap faces in any video effortlessly with our completely free AI face swap tool!

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Binance (BINANCE) contract to launch ALL 75x composite index U-standard perpetual contract

Aug 06, 2025 pm 06:48 PM

Binance (BINANCE) contract to launch ALL 75x composite index U-standard perpetual contract

Aug 06, 2025 pm 06:48 PM

Table of Contents About Binance ALL Comprehensive Index About Binance ALL Comprehensive Index Fixed-point adjustment component mechanism The newly launched U-standard perpetual contract with USDT quoted U-standard perpetual contract The Binance Contract is scheduled to officially launch the ALL75 times comprehensive index U-standard perpetual contract at 17:00 on August 6, 2025 (East Eighth District time). About Binance ALL Comprehensive Index Binance Exchange: Official Registration Official Download Binance ALL Comprehensive Index is designed to track the performance of all U-standard perpetual contracts denominated in USDT on the Binance Contract Platform, but the following types of contracts are not included: ETHBTC perpetual contracts quoted using USDC or other stablecoins U-standard delivery contracts All comprehensive index perpetual contracts are permanent

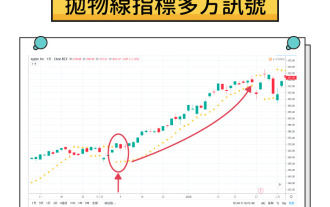

What is a parabolic SAR indicator? How does SAR indicator work? Comprehensive introduction to SAR indicators

Aug 06, 2025 pm 08:12 PM

What is a parabolic SAR indicator? How does SAR indicator work? Comprehensive introduction to SAR indicators

Aug 06, 2025 pm 08:12 PM

Contents Understand the mechanism of parabola SAR The working principle of parabola SAR calculation method and acceleration factor visual representation on trading charts Application of parabola SAR in cryptocurrency markets1. Identify potential trend reversal 2. Determine the best entry and exit points3. Set dynamic stop loss order case study: hypothetical ETH trading scenario Parabola SAR trading signals and interpretation Based on parabola SAR trading execution Combining parabola SAR with other indicators1. Use moving averages to confirm trend 2. Relative strength indicator (RSI) for momentum analysis3. Bollinger bands for volatility analysis Advantages of parabola SAR and limitations Advantages of parabola SAR

Cardano (ADA Coin) price forecast: 2025, 2026 and beyond

Aug 06, 2025 pm 07:33 PM

Cardano (ADA Coin) price forecast: 2025, 2026 and beyond

Aug 06, 2025 pm 07:33 PM

Directory What is Cardano? Key Features of Cardano How does Cardano work? Why Cardano deserves to consider price and market performance history 2025 ADA forecast 2025, 2026 and 2027 Price forecasts 2040 and 2030 ADA price forecast Factors affecting ADA costs Chart analysis and technical outlook Cardano Forecast Table: Key points summary As an important force in the cryptocurrency industry, Cardano (ADA) provides cutting-edge blockchain solutions with a focus on sustainability, scalability and security. Cardano is co-founder of Ethereum.

Solana (SOL Coin) Price Forecast: 2025-2030 and Future Outlook

Aug 06, 2025 pm 08:42 PM

Solana (SOL Coin) Price Forecast: 2025-2030 and Future Outlook

Aug 06, 2025 pm 08:42 PM

Table of Contents Solana's Price History and Important Market Data Important Data in Solana Price Chart: 2025 Solana Price Forecast: Optimistic 2026 Solana Price Forecast: Maintain Trend 2026 Solana Price Forecast: 2030 Solana Long-term Price Forecast: Top Blockchain? What affects the forecast of sun prices? Scalability and Solana: Competitive Advantages Should you invest in Solana in the next few years? Conclusion: Solana's price prospects Conclusion: Solana has its excellent scalability, low transaction costs and high efficiency

A detailed explanation of triangle arbitrage in the cryptocurrency market

Aug 06, 2025 pm 08:24 PM

A detailed explanation of triangle arbitrage in the cryptocurrency market

Aug 06, 2025 pm 08:24 PM

Table of Contents Triangle Arbitrage Introduction Cryptocurrency Triangle Arbitrage Mechanism Challenges: Identifying Opportunities Risks, Ethics and Regulatory Considerations Conclusion Triangle Arbitrage Introduction Triangle Arbitrage is a trading strategy aimed at capturing the temporary price mismatch between the three related assets, thereby achieving nearly risk-free returns. This strategy forms a closed loop by conducting continuous trading between three related trading pairs (such as BTC/ETH, ETH/USDT, USDT/BTC), and takes advantage of temporary imbalance in the exchange rate to make profits. Its essence comes from the basic principle of arbitrage, that is, price correction is carried out when market efficiency is insufficient, while the triangle form increases the complexity of operations through multiple steps of trading. Cryptocurrencies provide more frequent opportunities for triangle arbitrage compared to traditional forex markets. Forex market due to

What is open position in cryptocurrency? Comprehensive Guide to Open Positions

Aug 06, 2025 pm 08:27 PM

What is open position in cryptocurrency? Comprehensive Guide to Open Positions

Aug 06, 2025 pm 08:27 PM

Directory What is open position? Understand the importance of open positions in cryptocurrencies Where can I find open positions data? The role of open positions in market trends Comparison of open positions and trading volume Definition: Their indicative significance: Relationship: Market trend: Limitations of open positions Summary Thinking of common questions about open positions in cryptocurrencies 1. How to use open positions to confirm market trends? 2. What is the difference between open position volume and trading volume? 3. Is it always better to have higher open positions? 4. What is the role of open positions in evaluating market liquidity? 5. How to distinguish

Which blockchain does USDC stablecoin belong to? Which mainstream link networks do it support?

Aug 06, 2025 pm 10:45 PM

Which blockchain does USDC stablecoin belong to? Which mainstream link networks do it support?

Aug 06, 2025 pm 10:45 PM

USDC was first deployed on the Ethereum main network and adopted the ERC-20 standard. It currently supports more than ten mainstream blockchain networks including 1. Ethereum, 2. Polygon, 3. Arbitrum, 4. Optimism, 5. Solana, 6. Avalanche, 7. Base, 8. Stellar, 9. Tron, 10. Near, 11. Algorand, 12. Flow, etc. Each chain version is suitable for different scenarios. Users need to confirm the contract address through the Circle official website to ensure safe use.

Blockchain browser: a must-have tool for querying digital currency transaction information

Aug 06, 2025 pm 11:27 PM

Blockchain browser: a must-have tool for querying digital currency transaction information

Aug 06, 2025 pm 11:27 PM

Blockchain browser is a necessary tool for querying digital currency transaction information. It provides a visual interface for blockchain data, so that users can query transaction hash, block height, address balance and other information; its working principle includes data synchronization, parsing, indexing and user interface display; core functions cover querying transaction details, block information, address balance, token data and network status; when using it, you need to obtain TxID and select the corresponding blockchain browser such as Etherscan or Blockchain.com to search; query address information to view balance and transaction history by entering the address; mainstream browsers include Bitcoin's Blockchain.com, Ethereum's Etherscan.io, B