web3.0

web3.0

What are the top ten mainstream coins in the currency circle? What are the mainstream currency trading websites?

What are the top ten mainstream coins in the currency circle? What are the mainstream currency trading websites?

What are the top ten mainstream coins in the currency circle? What are the mainstream currency trading websites?

Apr 22, 2025 am 06:42 AMThe top ten mainstream currencies in the currency circle include: 1. Bitcoin (BTC), the earliest digital currency; 2. Ethereum (ETH), smart contract platform; 3. Ripple (XRP), cross-border payment solution; 4. Litecoin (LTC), a fast-trading cryptocurrency; 5. Bitcoin Cash (BCH), a fork coin that improves transaction throughput; 6. EOS, a high-performance blockchain platform; 7. Stellar (XLM), a global fast transfer network; 8. Cardano (ADA), a computing platform with a hierarchical architecture; 9. Chainlink (LINK), a decentralized oracle network; 10. Polkadot (DOT), a decentralized network that supports multi-chain architecture.

The above is the detailed content of What are the top ten mainstream coins in the currency circle? What are the mainstream currency trading websites?. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undress AI Tool

Undress images for free

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Clothoff.io

AI clothes remover

Video Face Swap

Swap faces in any video effortlessly with our completely free AI face swap tool!

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Binance (BINANCE) contract to launch ALL 75x composite index U-standard perpetual contract

Aug 06, 2025 pm 06:48 PM

Binance (BINANCE) contract to launch ALL 75x composite index U-standard perpetual contract

Aug 06, 2025 pm 06:48 PM

Table of Contents About Binance ALL Comprehensive Index About Binance ALL Comprehensive Index Fixed-point adjustment component mechanism The newly launched U-standard perpetual contract with USDT quoted U-standard perpetual contract The Binance Contract is scheduled to officially launch the ALL75 times comprehensive index U-standard perpetual contract at 17:00 on August 6, 2025 (East Eighth District time). About Binance ALL Comprehensive Index Binance Exchange: Official Registration Official Download Binance ALL Comprehensive Index is designed to track the performance of all U-standard perpetual contracts denominated in USDT on the Binance Contract Platform, but the following types of contracts are not included: ETHBTC perpetual contracts quoted using USDC or other stablecoins U-standard delivery contracts All comprehensive index perpetual contracts are permanent

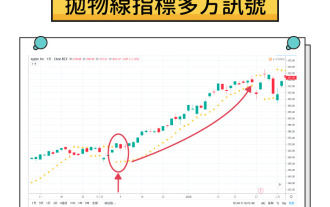

What is a parabolic SAR indicator? How does SAR indicator work? Comprehensive introduction to SAR indicators

Aug 06, 2025 pm 08:12 PM

What is a parabolic SAR indicator? How does SAR indicator work? Comprehensive introduction to SAR indicators

Aug 06, 2025 pm 08:12 PM

Contents Understand the mechanism of parabola SAR The working principle of parabola SAR calculation method and acceleration factor visual representation on trading charts Application of parabola SAR in cryptocurrency markets1. Identify potential trend reversal 2. Determine the best entry and exit points3. Set dynamic stop loss order case study: hypothetical ETH trading scenario Parabola SAR trading signals and interpretation Based on parabola SAR trading execution Combining parabola SAR with other indicators1. Use moving averages to confirm trend 2. Relative strength indicator (RSI) for momentum analysis3. Bollinger bands for volatility analysis Advantages of parabola SAR and limitations Advantages of parabola SAR

Cardano (ADA Coin) price forecast: 2025, 2026 and beyond

Aug 06, 2025 pm 07:33 PM

Cardano (ADA Coin) price forecast: 2025, 2026 and beyond

Aug 06, 2025 pm 07:33 PM

Directory What is Cardano? Key Features of Cardano How does Cardano work? Why Cardano deserves to consider price and market performance history 2025 ADA forecast 2025, 2026 and 2027 Price forecasts 2040 and 2030 ADA price forecast Factors affecting ADA costs Chart analysis and technical outlook Cardano Forecast Table: Key points summary As an important force in the cryptocurrency industry, Cardano (ADA) provides cutting-edge blockchain solutions with a focus on sustainability, scalability and security. Cardano is co-founder of Ethereum.

Solana (SOL Coin) Price Forecast: 2025-2030 and Future Outlook

Aug 06, 2025 pm 08:42 PM

Solana (SOL Coin) Price Forecast: 2025-2030 and Future Outlook

Aug 06, 2025 pm 08:42 PM

Table of Contents Solana's Price History and Important Market Data Important Data in Solana Price Chart: 2025 Solana Price Forecast: Optimistic 2026 Solana Price Forecast: Maintain Trend 2026 Solana Price Forecast: 2030 Solana Long-term Price Forecast: Top Blockchain? What affects the forecast of sun prices? Scalability and Solana: Competitive Advantages Should you invest in Solana in the next few years? Conclusion: Solana's price prospects Conclusion: Solana has its excellent scalability, low transaction costs and high efficiency

What is open position in cryptocurrency? Comprehensive Guide to Open Positions

Aug 06, 2025 pm 08:27 PM

What is open position in cryptocurrency? Comprehensive Guide to Open Positions

Aug 06, 2025 pm 08:27 PM

Directory What is open position? Understand the importance of open positions in cryptocurrencies Where can I find open positions data? The role of open positions in market trends Comparison of open positions and trading volume Definition: Their indicative significance: Relationship: Market trend: Limitations of open positions Summary Thinking of common questions about open positions in cryptocurrencies 1. How to use open positions to confirm market trends? 2. What is the difference between open position volume and trading volume? 3. Is it always better to have higher open positions? 4. What is the role of open positions in evaluating market liquidity? 5. How to distinguish

Blockstream launches Simplicity to bring new alternatives to Ethereum (ETH) Solidity

Aug 06, 2025 pm 08:45 PM

Blockstream launches Simplicity to bring new alternatives to Ethereum (ETH) Solidity

Aug 06, 2025 pm 08:45 PM

The rise of a dedicated smart contract programming language for different architectures. Blockstream, led by AdamBack, officially launched Simplicity, a native smart contract language designed for Bitcoin, providing Ethereum's Solidity with a new competitive option. As the creator of Liquid, Bitcoin’s second-layer network, Blockstream has a deep background in the field of encryption, and its leader AdamBack is a key figure in the history of Bitcoin’s development. The Simplicity language released this time aims to introduce stronger programmability into the Bitcoin ecosystem. According to the company's news to Cointelegraph on Thursday, Simplicit

Ethereum (ETH) price forecast: ETH rises 8%, one article analysis

Aug 06, 2025 pm 07:24 PM

Ethereum (ETH) price forecast: ETH rises 8%, one article analysis

Aug 06, 2025 pm 07:24 PM

Table of Contents Market sentiment and technical indicators double support bullish trend Key price levels and breakthrough target Medium- and long-term forecast: Three major drivers of the year-end target $7,000–$8,000 Risk warning: Volatility and macro uncertainty Conclusion: August may be the "gold window" on the eve of the breakthrough, the bullish trend market optimism continues to heat up, the crypto fear and greed index climbed to 72, entering the "greed" area, indicating that investor confidence has increased significantly. The technical aspect shows a comprehensive bullish pattern: among the 28 core indicators, up to 90% have been converted into buy signals, covering MACD, 10-day index moving average and multi-cycle moving average systems. Relative Strength Index (RSI) is stable at 55 levels and has not yet hit the overbought threshold, suggesting an uptrend

A detailed explanation of triangle arbitrage in the cryptocurrency market

Aug 06, 2025 pm 08:24 PM

A detailed explanation of triangle arbitrage in the cryptocurrency market

Aug 06, 2025 pm 08:24 PM

Table of Contents Triangle Arbitrage Introduction Cryptocurrency Triangle Arbitrage Mechanism Challenges: Identifying Opportunities Risks, Ethics and Regulatory Considerations Conclusion Triangle Arbitrage Introduction Triangle Arbitrage is a trading strategy aimed at capturing the temporary price mismatch between the three related assets, thereby achieving nearly risk-free returns. This strategy forms a closed loop by conducting continuous trading between three related trading pairs (such as BTC/ETH, ETH/USDT, USDT/BTC), and takes advantage of temporary imbalance in the exchange rate to make profits. Its essence comes from the basic principle of arbitrage, that is, price correction is carried out when market efficiency is insufficient, while the triangle form increases the complexity of operations through multiple steps of trading. Cryptocurrencies provide more frequent opportunities for triangle arbitrage compared to traditional forex markets. Forex market due to