Calculate compound interest in Excel: formula and calculator

May 11, 2025 am 09:15 AMThis tutorial explains how to calculate compound interest in Excel, providing examples for annual, monthly, and daily compounding. You'll learn to build your own Excel compound interest calculator.

Compound interest, a fundamental concept in finance, significantly impacts investment growth. While complex for non-finance professionals, this guide simplifies the process. You'll also learn to create a versatile compound interest calculator for your spreadsheets.

What is Compound Interest?

Simply put, compound interest is interest earned on both the principal and accumulated interest. Unlike simple interest, calculated solely on the principal, compound interest increases the principal with each compounding period. For example, $10 invested at 7% annual interest yields $10.70 after one year. With compound interest, that $0.70 is added to the principal, earning interest in subsequent years.

Calculating Compound Interest in Excel

Long-term investments benefit greatly from compounding. Excel formulas can effectively model this growth. We'll build a formula adaptable to various compounding frequencies.

Calculating Annual Compound Interest in Excel

Let's start with a simple example: $10 invested at 7% annual interest.

Formula 1: A straightforward approach uses the formula =Amount * (1 %). For a $10 investment (A2) and 7% interest (B2), the formula is =A2*(1 $B2). This calculates the balance after one year. Repeating this formula for subsequent years demonstrates the compounding effect.

Formula 2: Alternatively, calculate yearly interest and add it to the previous year's balance. With initial deposit in B1 and interest rate in B2, the formula for year 1 is =B1 B1 * $B$2. For subsequent years (e.g., B6), use =B5 B5 * $B$2. This method clearly shows the interest earned each year.

These examples illustrate the concept, but lack flexibility in compounding frequency. Let's create a more versatile formula.

General Compound Interest Formula

The future value (FV) of an investment is determined by:

- PV: Present value (initial investment)

- i: Interest rate per period

- n: Number of periods

The formula is: FV = PV * (1 i)n

Example: Monthly Compounding

$2,000 invested at 8% annual interest, compounded monthly for 5 years:

PV = $2,000 i = 0.08/12 (monthly interest rate) n = 5 * 12 (number of months)

FV = $2,000 * (1 0.08/12)60 = $2,979.69

Excel Compound Interest Formula (Daily, Monthly, Yearly)

We'll create an Excel calculator with:

- Initial investment

- Annual interest rate

- Compounding periods per year

- Number of years

The formula is: =Initial Investment * (1 Annual Interest Rate / Compounding Periods) ^ (Years * Compounding Periods)

This formula adapts to different compounding frequencies (daily, weekly, monthly, etc.) by changing the "Compounding Periods" input.

Advanced Excel Compound Interest Calculator

Excel's FV function offers another approach: FV(rate, nper, pmt, [pv], [type]).

Using the monthly compounding example: =FV(0.08/12, 5*12, ,-2000) (pv is negative for outflow). This provides the same result.

This can be enhanced by adding optional additional contributions.

Online Compound Interest Calculators

Several online calculators simplify compound interest calculations. Bankrate, Money-Zine, and MoneySmart offer user-friendly interfaces with varying features.

This tutorial provides both manual and Excel-based methods for compound interest calculations, empowering you to manage your investments effectively. A downloadable Excel workbook is available.

The above is the detailed content of Calculate compound interest in Excel: formula and calculator. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undress AI Tool

Undress images for free

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Clothoff.io

AI clothes remover

Video Face Swap

Swap faces in any video effortlessly with our completely free AI face swap tool!

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Hot Topics

How to Use Parentheses, Square Brackets, and Curly Braces in Microsoft Excel

Jun 19, 2025 am 03:03 AM

How to Use Parentheses, Square Brackets, and Curly Braces in Microsoft Excel

Jun 19, 2025 am 03:03 AM

Quick Links Parentheses: Controlling the Order of Opera

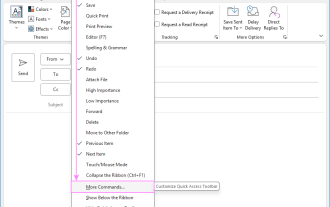

Outlook Quick Access Toolbar: customize, move, hide and show

Jun 18, 2025 am 11:01 AM

Outlook Quick Access Toolbar: customize, move, hide and show

Jun 18, 2025 am 11:01 AM

This guide will walk you through how to customize, move, hide, and show the Quick Access Toolbar, helping you shape your Outlook workspace to fit your daily routine and preferences. The Quick Access Toolbar in Microsoft Outlook is a usefu

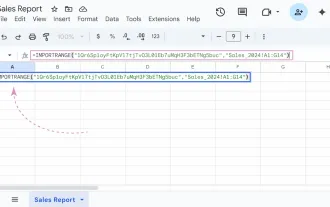

Google Sheets IMPORTRANGE: The Complete Guide

Jun 18, 2025 am 09:54 AM

Google Sheets IMPORTRANGE: The Complete Guide

Jun 18, 2025 am 09:54 AM

Ever played the "just one quick copy-paste" game with Google Sheets... and lost an hour of your life? What starts as a simple data transfer quickly snowballs into a nightmare when working with dynamic information. Those "quick fixes&qu

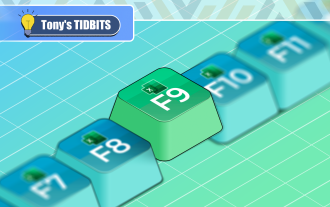

Don't Ignore the Power of F9 in Microsoft Excel

Jun 21, 2025 am 06:23 AM

Don't Ignore the Power of F9 in Microsoft Excel

Jun 21, 2025 am 06:23 AM

Quick LinksRecalculating Formulas in Manual Calculation ModeDebugging Complex FormulasMinimizing the Excel WindowMicrosoft Excel has so many keyboard shortcuts that it can sometimes be difficult to remember the most useful. One of the most overlooked

6 Cool Right-Click Tricks in Microsoft Excel

Jun 24, 2025 am 12:55 AM

6 Cool Right-Click Tricks in Microsoft Excel

Jun 24, 2025 am 12:55 AM

Quick Links Copy, Move, and Link Cell Elements

Prove Your Real-World Microsoft Excel Skills With the How-To Geek Test (Advanced)

Jun 17, 2025 pm 02:44 PM

Prove Your Real-World Microsoft Excel Skills With the How-To Geek Test (Advanced)

Jun 17, 2025 pm 02:44 PM

Whether you've recently taken a Microsoft Excel course or you want to verify that your knowledge of the program is current, try out the How-To Geek Advanced Excel Test and find out how well you do!This is the third in a three-part series. The first i

How to recover unsaved Word document

Jun 27, 2025 am 11:36 AM

How to recover unsaved Word document

Jun 27, 2025 am 11:36 AM

1. Check the automatic recovery folder, open "Recover Unsaved Documents" in Word or enter the C:\Users\Users\Username\AppData\Roaming\Microsoft\Word path to find the .asd ending file; 2. Find temporary files or use OneDrive historical version, enter ~$ file name.docx in the original directory to see if it exists or log in to OneDrive to view the version history; 3. Use Windows' "Previous Versions" function or third-party tools such as Recuva and EaseUS to scan and restore and completely delete files. The above methods can improve the recovery success rate, but you need to operate as soon as possible and avoid writing new data. Automatic saving, regular saving or cloud use should be enabled

5 New Microsoft Excel Features to Try in July 2025

Jul 02, 2025 am 03:02 AM

5 New Microsoft Excel Features to Try in July 2025

Jul 02, 2025 am 03:02 AM

Quick Links Let Copilot Determine Which Table to Manipu