Detailed analysis of six different stablecoin types in 2025 (with APP included)

Jul 16, 2025 am 07:57 AMThe stablecoin ecosystem will be more mature and diversified. For most users, fiat-staking stablecoins are still the first choice for their simplicity and high liquidity. Users who pursue higher decentralization and transparency can choose to crypto assets to pledge stablecoins. Mixed and algorithmic stablecoins represent the industry's exploration direction, and you must fully understand their high-risk characteristics before participating. With the gradual implementation of CBDC, it will also play an important role in specific scenarios. Which stablecoin to choose ultimately depends on your comprehensive consideration of security, degree of decentralization, capital efficiency, and risk.

1. Stablecoin Security Trading Network

- Binance:

- OK:

- Huobi:

- Gate.io:

2. Fiat currency mortgage stablecoin

This is the most common and intuitive type of stablecoin. Their value remains an 1:1 anchor relationship with traditional fiat currencies such as the US dollar, and the issuer will hold a fiat currency reserve of equal value as support.

Working principle: The user deposits one unit of fiat currency, the issuer mints and distributes one unit of stablecoin. On the contrary, when the user redeems, the stablecoin is destroyed and fiat currency is returned.

Representative items: USDT (Tether), USDC (USD Coin).

Advantages: The mechanism is simple and easy to understand, with high value stability, good liquidity, and is widely accepted.

Risk warning: Relying on centralized institutions requires trusting the issuer to indeed hold full reserves. The transparency of reserves and audit status are key.

Common APPs: Almost all mainstream trading platforms (such as Coinbase, OKX) and digital currency (such as Trust Wallet, MetaMask) support it.

3. Crypto Asset Mortgage Stable Coins

Such stablecoins do not rely on traditional financial systems, but are generated by staking other crypto assets such as Ethereum. To cope with fluctuations in collateral prices, over-collateral is usually required.

How it works: Users lock crypto assets worth more than $1 (such as $1.5 ETH) into smart contracts, thereby lending $1 of stablecoins.

Representative Project: DAI (MakerDAO).

Advantages: High degree of decentralization, transparent assets, all operations can be checked on the chain, and there is no need to trust third-party institutions.

Risk warning: The mechanism is relatively complex. When the value of collateral falls sharply, you may face liquidation risks. Low capital efficiency.

Common APP: It can be generated on the MakerDAO official platform and used in decentralized applications such as Aave and Compound.

4. Commodity mortgage stablecoin

The value of this type of stablecoins is linked to physical commodities such as gold and oil. Each token represents a certain amount of physical goods ownership.

How it works: The issuer purchases and stores physical goods (such as gold) and then issues digital tokens that represent ownership of those goods.

Representative items: PAXG (Paxos Gold), each token represents a troy ounce of gold.

Advantages: Value is anchored on a historic store of value assets, providing diversity to the portfolio.

Risk warning: Its value stability is relative to the commodity, not a certain fiat currency. It is also necessary to trust the centralized institutions that custody physical assets.

Common APP: It can be obtained on the Paxos platform or some large trading platforms.

5. Algorithm stablecoin

This is a very innovative but riskiest stablecoin. It does not rely on any collateral, but automatically adjusts the supply in the market through a set of algorithms and smart contracts to maintain price stability.

How it works: When the price of a stablecoin is higher than 1 USD, the system issues additional prices to reduce the price. When the price is below $1, the system reduces supply through repurchase, destruction or other incentives to increase the price.

Representative projects: There have been projects such as UST, but failed due to their vulnerability. The market is currently very cautious about such projects.

Advantages: Decentralization in the true sense, extremely high capital efficiency.

Risk warning: It is extremely susceptible to extreme market sentiment, and a "death spiral" may occur, resulting in an instant collapse of value, which is extremely high.

Common APPs: They mainly exist in some specific decentralized financial protocols, and users need to have extremely high risk awareness.

6. Mixed stablecoins

Hybrid stablecoins try to combine the advantages of different models, such as partly collateralized by fiat currency or crypto assets and partly regulated by algorithms to seek a balance between stability, decentralization and capital efficiency.

Working principle: Combines two mechanisms: mortgage and algorithm. For example, a stablecoin may be supported by 80% USDC and 20% governance tokens through algorithms.

Representative Project: FRAX.

Advantages: It is more resilient than pure algorithm stablecoins and has higher capital efficiency than pure collateral stablecoins.

Risk warning: The complexity of the model may hide new risks and it still needs to be paid attention to its performance in stressful environments.

Common APPs: Frax Finance protocol, and mainstream decentralized trading platforms.

The above is the detailed content of Detailed analysis of six different stablecoin types in 2025 (with APP included). For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undress AI Tool

Undress images for free

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Clothoff.io

AI clothes remover

Video Face Swap

Swap faces in any video effortlessly with our completely free AI face swap tool!

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Binance official website only entrance correct address

Aug 06, 2025 pm 11:33 PM

Binance official website only entrance correct address

Aug 06, 2025 pm 11:33 PM

The only correct entry for Binance official website is the official website with a domain name ending with .com, and there are no extra symbols or subdirectories; 2. To verify the authenticity of the official website, you need to check the SSL certificate, check the domain name through official social media, and be wary of phishing links; 3. Common fraud methods include counterfeit domain names, false customer service inducement and APP download traps through non-official channels; 4. Safe access suggestions include enabling two-factor verification, using browser bookmarks to save the official website address and regularly check the device authorization status to ensure the security and integrity of the account.

Binance (BINANCE) contract to launch ALL 75x composite index U-standard perpetual contract

Aug 06, 2025 pm 06:48 PM

Binance (BINANCE) contract to launch ALL 75x composite index U-standard perpetual contract

Aug 06, 2025 pm 06:48 PM

Table of Contents About Binance ALL Comprehensive Index About Binance ALL Comprehensive Index Fixed-point adjustment component mechanism The newly launched U-standard perpetual contract with USDT quoted U-standard perpetual contract The Binance Contract is scheduled to officially launch the ALL75 times comprehensive index U-standard perpetual contract at 17:00 on August 6, 2025 (East Eighth District time). About Binance ALL Comprehensive Index Binance Exchange: Official Registration Official Download Binance ALL Comprehensive Index is designed to track the performance of all U-standard perpetual contracts denominated in USDT on the Binance Contract Platform, but the following types of contracts are not included: ETHBTC perpetual contracts quoted using USDC or other stablecoins U-standard delivery contracts All comprehensive index perpetual contracts are permanent

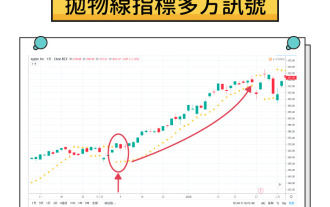

What is a parabolic SAR indicator? How does SAR indicator work? Comprehensive introduction to SAR indicators

Aug 06, 2025 pm 08:12 PM

What is a parabolic SAR indicator? How does SAR indicator work? Comprehensive introduction to SAR indicators

Aug 06, 2025 pm 08:12 PM

Contents Understand the mechanism of parabola SAR The working principle of parabola SAR calculation method and acceleration factor visual representation on trading charts Application of parabola SAR in cryptocurrency markets1. Identify potential trend reversal 2. Determine the best entry and exit points3. Set dynamic stop loss order case study: hypothetical ETH trading scenario Parabola SAR trading signals and interpretation Based on parabola SAR trading execution Combining parabola SAR with other indicators1. Use moving averages to confirm trend 2. Relative strength indicator (RSI) for momentum analysis3. Bollinger bands for volatility analysis Advantages of parabola SAR and limitations Advantages of parabola SAR

Solana (SOL Coin) Price Forecast: 2025-2030 and Future Outlook

Aug 06, 2025 pm 08:42 PM

Solana (SOL Coin) Price Forecast: 2025-2030 and Future Outlook

Aug 06, 2025 pm 08:42 PM

Table of Contents Solana's Price History and Important Market Data Important Data in Solana Price Chart: 2025 Solana Price Forecast: Optimistic 2026 Solana Price Forecast: Maintain Trend 2026 Solana Price Forecast: 2030 Solana Long-term Price Forecast: Top Blockchain? What affects the forecast of sun prices? Scalability and Solana: Competitive Advantages Should you invest in Solana in the next few years? Conclusion: Solana's price prospects Conclusion: Solana has its excellent scalability, low transaction costs and high efficiency

Which blockchain does USDC stablecoin belong to? Which mainstream link networks do it support?

Aug 06, 2025 pm 10:45 PM

Which blockchain does USDC stablecoin belong to? Which mainstream link networks do it support?

Aug 06, 2025 pm 10:45 PM

USDC was first deployed on the Ethereum main network and adopted the ERC-20 standard. It currently supports more than ten mainstream blockchain networks including 1. Ethereum, 2. Polygon, 3. Arbitrum, 4. Optimism, 5. Solana, 6. Avalanche, 7. Base, 8. Stellar, 9. Tron, 10. Near, 11. Algorand, 12. Flow, etc. Each chain version is suitable for different scenarios. Users need to confirm the contract address through the Circle official website to ensure safe use.

Cardano (ADA Coin) price forecast: 2025, 2026 and beyond

Aug 06, 2025 pm 07:33 PM

Cardano (ADA Coin) price forecast: 2025, 2026 and beyond

Aug 06, 2025 pm 07:33 PM

Directory What is Cardano? Key Features of Cardano How does Cardano work? Why Cardano deserves to consider price and market performance history 2025 ADA forecast 2025, 2026 and 2027 Price forecasts 2040 and 2030 ADA price forecast Factors affecting ADA costs Chart analysis and technical outlook Cardano Forecast Table: Key points summary As an important force in the cryptocurrency industry, Cardano (ADA) provides cutting-edge blockchain solutions with a focus on sustainability, scalability and security. Cardano is co-founder of Ethereum.

Blockchain browser: a must-have tool for querying digital currency transaction information

Aug 06, 2025 pm 11:27 PM

Blockchain browser: a must-have tool for querying digital currency transaction information

Aug 06, 2025 pm 11:27 PM

Blockchain browser is a necessary tool for querying digital currency transaction information. It provides a visual interface for blockchain data, so that users can query transaction hash, block height, address balance and other information; its working principle includes data synchronization, parsing, indexing and user interface display; core functions cover querying transaction details, block information, address balance, token data and network status; when using it, you need to obtain TxID and select the corresponding blockchain browser such as Etherscan or Blockchain.com to search; query address information to view balance and transaction history by entering the address; mainstream browsers include Bitcoin's Blockchain.com, Ethereum's Etherscan.io, B

Binance Exchange Official Website Portal Binance Exchange App Official Mobile Version Portal

Aug 06, 2025 pm 11:30 PM

Binance Exchange Official Website Portal Binance Exchange App Official Mobile Version Portal

Aug 06, 2025 pm 11:30 PM

Founded in 2017 by Zhao Changpeng, Binance is the world's leading cryptocurrency trading platform, known for its high liquidity, low transaction rates and rich trading pairs. 1. The official website entrance is: [adid]fbd7939d674997cdb4692d34de8633c4[/adid]. Users in some regions need to use vp n or visit regional branch stations; 2. The official APP download method includes: through the official website/iOS download link [adid]9f61408e3afb633e50cdf1b20de6f466[/adid], or download the APK installation package [adid]758691fdf7ae3403db0d3bd