web3.0

web3.0

What are the popular currency speculation apps in the world? Comparison of fees and services of the top ten trading platforms

What are the popular currency speculation apps in the world? Comparison of fees and services of the top ten trading platforms

What are the popular currency speculation apps in the world? Comparison of fees and services of the top ten trading platforms

Jul 22, 2025 pm 11:00 PM1. The preferred platforms are Binance, OKX and Coinbase, which are suitable for advanced users, Web3 explorers and beginners respectively; 2. Special platforms such as HTX are stable and reliable, KuCoin is good at New Coins, Gate.io projects are rich, and Bitget supports follow-up transactions; 3. Other recommendations include Bybit (strong contracts), Kraken (safety compliance), and MEXC (low rates and fast new launches). When choosing, you should combine your own needs and be sure to enable 2FA to ensure asset security.

1. A strong head platform with comprehensive strength

These platforms have a huge base of users, good liquidity, and comprehensive functions, which is suitable for most users.

1. Binance

As a platform with far-leading trading volume in the world, Binance provides an extremely rich variety of digital investment products and comprehensive trading tools. Its spot transaction fee rate (Maker/Taker) is usually around 0.1%, and you can also enjoy discounts using its platform token. The app has powerful functions and covers various services such as spot, contracts, and financial management. However, for pure novices, the interface information is large and may require a certain amount of learning time.

2. OKX

OKX is another top comprehensive trading platform, known for its strong Web3 ecosystem and integrated services. Its transaction fees are comparable to Binance, and it also offers ladder rates and platform token discounts. OKX's APP is designed in a relatively modern way, integrating transactions and decentralized application portals well, and is very friendly to users exploring new fields.

3. Coinbase

Coinbase is a compliance platform listed in the United States. It is known for its security and ease of use. It is especially popular among European and American users and is very suitable for beginners. The basic version of the APP is extremely simple to operate, but the handling fee is relatively high. For experienced traders, they can use their professional version (formerly Coinbase Pro), and the rates will be significantly reduced and they will be more competitive.

2. Platforms with unique functions and services

These platforms have performed well in specific areas, such as contract trading or new projects coming online at a fast pace.

1. HTX (formerly Huobi)

As an old trading platform, HTX has a deep user base and brand accumulation. The platform has a wide variety of assets and a stable trading experience. Although it has undergone brand upgrades and strategic adjustments in recent years, its core transaction functions are still reliable.

2. KuCoin

Known as the "Paradise for New Coin Hunters", KuCoin is famous for its large number of potential emerging projects online. If you are keen on finding the next 100x project, it is worth paying attention to here. Its transaction fees are moderate and the platform activities are rich, but users need to have certain project identification capabilities.

3. Gate.io

It is also a platform known for its wide variety of assets, Gate.io's new projects launched are very fast, covering many sub-tracks. Its handling fee rate is medium in the industry and provides a variety of financial management and start-up services, providing users with opportunities to participate in projects in the early stage.

4. Bitget

Bitget stands out with its innovative order-follow trading capabilities, allowing users to copy the operational strategies of excellent traders in one click, which is extremely attractive for inexperienced novices or users who don’t have time to watch the market. The platform also has strong competitiveness in the derivatives market.

3. Other platforms worth paying attention to

1. Bybit

Bybit was famous for its derivatives trading in the early days, and the depth and experience of its contract products are well-known in the industry. In recent years, it has also been actively expanding the spot market and launched a large number of popular assets. Its handling fee structure is clear, liquidity is good, and the APP is fast response speed, which is very popular among contract trading enthusiasts.

2. Kraken

Kraken is a platform with a long history and is known for its security, especially in the European and American markets. It does a great job in compliance, has a transparent handling fee structure, and has a high customer service rating, making it suitable for robust users who focus on security and long-term holding.

3. MEXC

MEXC has attracted a large number of users with its highly competitive fee policy and rapid new launch. It is often called the "Next KuCoin", which performs well in the discovery of new projects, and its spot trading rates are among the lowest in the industry and are very friendly to high-frequency traders.

Editor's summary

In short, there is no absolute best when choosing a trading platform, only the best suits. Newbie users can prioritize platforms like Coinbase or OKX with a friendly interface and clear guidance; experienced traders may pay more attention to Binance’s depth, Bybit’s contract experience or KuCoin’s new coin opportunities. No matter which platform you choose, please be sure to put account security first and enable secondary verification (2FA) and other security measures to ensure the security of your digital assets. Please do a good job of research and understanding before conducting any transaction.

The above is the detailed content of What are the popular currency speculation apps in the world? Comparison of fees and services of the top ten trading platforms. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undress AI Tool

Undress images for free

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Clothoff.io

AI clothes remover

Video Face Swap

Swap faces in any video effortlessly with our completely free AI face swap tool!

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

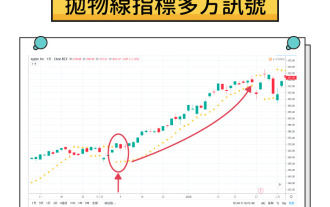

What is a parabolic SAR indicator? How does SAR indicator work? Comprehensive introduction to SAR indicators

Aug 06, 2025 pm 08:12 PM

What is a parabolic SAR indicator? How does SAR indicator work? Comprehensive introduction to SAR indicators

Aug 06, 2025 pm 08:12 PM

Contents Understand the mechanism of parabola SAR The working principle of parabola SAR calculation method and acceleration factor visual representation on trading charts Application of parabola SAR in cryptocurrency markets1. Identify potential trend reversal 2. Determine the best entry and exit points3. Set dynamic stop loss order case study: hypothetical ETH trading scenario Parabola SAR trading signals and interpretation Based on parabola SAR trading execution Combining parabola SAR with other indicators1. Use moving averages to confirm trend 2. Relative strength indicator (RSI) for momentum analysis3. Bollinger bands for volatility analysis Advantages of parabola SAR and limitations Advantages of parabola SAR

Cardano (ADA Coin) price forecast: 2025, 2026 and beyond

Aug 06, 2025 pm 07:33 PM

Cardano (ADA Coin) price forecast: 2025, 2026 and beyond

Aug 06, 2025 pm 07:33 PM

Directory What is Cardano? Key Features of Cardano How does Cardano work? Why Cardano deserves to consider price and market performance history 2025 ADA forecast 2025, 2026 and 2027 Price forecasts 2040 and 2030 ADA price forecast Factors affecting ADA costs Chart analysis and technical outlook Cardano Forecast Table: Key points summary As an important force in the cryptocurrency industry, Cardano (ADA) provides cutting-edge blockchain solutions with a focus on sustainability, scalability and security. Cardano is co-founder of Ethereum.

Ethereum (ETH) price forecast: ETH rises 8%, one article analysis

Aug 06, 2025 pm 07:24 PM

Ethereum (ETH) price forecast: ETH rises 8%, one article analysis

Aug 06, 2025 pm 07:24 PM

Table of Contents Market sentiment and technical indicators double support bullish trend Key price levels and breakthrough target Medium- and long-term forecast: Three major drivers of the year-end target $7,000–$8,000 Risk warning: Volatility and macro uncertainty Conclusion: August may be the "gold window" on the eve of the breakthrough, the bullish trend market optimism continues to heat up, the crypto fear and greed index climbed to 72, entering the "greed" area, indicating that investor confidence has increased significantly. The technical aspect shows a comprehensive bullish pattern: among the 28 core indicators, up to 90% have been converted into buy signals, covering MACD, 10-day index moving average and multi-cycle moving average systems. Relative Strength Index (RSI) is stable at 55 levels and has not yet hit the overbought threshold, suggesting an uptrend

A detailed explanation of triangle arbitrage in the cryptocurrency market

Aug 06, 2025 pm 08:24 PM

A detailed explanation of triangle arbitrage in the cryptocurrency market

Aug 06, 2025 pm 08:24 PM

Table of Contents Triangle Arbitrage Introduction Cryptocurrency Triangle Arbitrage Mechanism Challenges: Identifying Opportunities Risks, Ethics and Regulatory Considerations Conclusion Triangle Arbitrage Introduction Triangle Arbitrage is a trading strategy aimed at capturing the temporary price mismatch between the three related assets, thereby achieving nearly risk-free returns. This strategy forms a closed loop by conducting continuous trading between three related trading pairs (such as BTC/ETH, ETH/USDT, USDT/BTC), and takes advantage of temporary imbalance in the exchange rate to make profits. Its essence comes from the basic principle of arbitrage, that is, price correction is carried out when market efficiency is insufficient, while the triangle form increases the complexity of operations through multiple steps of trading. Cryptocurrencies provide more frequent opportunities for triangle arbitrage compared to traditional forex markets. Forex market due to

What is open position in cryptocurrency? Comprehensive Guide to Open Positions

Aug 06, 2025 pm 08:27 PM

What is open position in cryptocurrency? Comprehensive Guide to Open Positions

Aug 06, 2025 pm 08:27 PM

Directory What is open position? Understand the importance of open positions in cryptocurrencies Where can I find open positions data? The role of open positions in market trends Comparison of open positions and trading volume Definition: Their indicative significance: Relationship: Market trend: Limitations of open positions Summary Thinking of common questions about open positions in cryptocurrencies 1. How to use open positions to confirm market trends? 2. What is the difference between open position volume and trading volume? 3. Is it always better to have higher open positions? 4. What is the role of open positions in evaluating market liquidity? 5. How to distinguish

Solana (SOL Coin) Price Forecast: 2025-2030 and Future Outlook

Aug 06, 2025 pm 08:42 PM

Solana (SOL Coin) Price Forecast: 2025-2030 and Future Outlook

Aug 06, 2025 pm 08:42 PM

Table of Contents Solana's Price History and Important Market Data Important Data in Solana Price Chart: 2025 Solana Price Forecast: Optimistic 2026 Solana Price Forecast: Maintain Trend 2026 Solana Price Forecast: 2030 Solana Long-term Price Forecast: Top Blockchain? What affects the forecast of sun prices? Scalability and Solana: Competitive Advantages Should you invest in Solana in the next few years? Conclusion: Solana's price prospects Conclusion: Solana has its excellent scalability, low transaction costs and high efficiency

Blockstream launches Simplicity to bring new alternatives to Ethereum (ETH) Solidity

Aug 06, 2025 pm 08:45 PM

Blockstream launches Simplicity to bring new alternatives to Ethereum (ETH) Solidity

Aug 06, 2025 pm 08:45 PM

The rise of a dedicated smart contract programming language for different architectures. Blockstream, led by AdamBack, officially launched Simplicity, a native smart contract language designed for Bitcoin, providing Ethereum's Solidity with a new competitive option. As the creator of Liquid, Bitcoin’s second-layer network, Blockstream has a deep background in the field of encryption, and its leader AdamBack is a key figure in the history of Bitcoin’s development. The Simplicity language released this time aims to introduce stronger programmability into the Bitcoin ecosystem. According to the company's news to Cointelegraph on Thursday, Simplicit

The top ten currency trading platforms in the world, the top ten trading software apps in the currency circle

Aug 06, 2025 pm 11:42 PM

The top ten currency trading platforms in the world, the top ten trading software apps in the currency circle

Aug 06, 2025 pm 11:42 PM

Binance: is known for its high liquidity, multi-currency support, diversified trading modes and powerful security systems; 2. OKX: provides diversified trading products, layout DeFi and NFT, and has a high-performance matching engine; 3. Huobi: deeply engaged in the Asian market, pays attention to compliance operations, and provides professional services; 4. Coinbase: strong compliance, friendly interface, suitable for novices and is a listed company; 5. Kraken: strict security measures, supports multiple fiat currencies, and has high transparency; 6. Bybit: focuses on derivative trading, low latency, and complete risk control; 7. KuCoin: rich currency, supports emerging projects, and can enjoy dividends with KCS; 8. Gate.io: frequent new coins, with Copy Tr