web3.0

web3.0

2025 Cryptocurrency Market Outlook: How do policies, institutions and technological innovations affect trends?

2025 Cryptocurrency Market Outlook: How do policies, institutions and technological innovations affect trends?

2025 Cryptocurrency Market Outlook: How do policies, institutions and technological innovations affect trends?

Jul 23, 2025 pm 10:15 PMIn 2025, the cryptocurrency market will be driven by three major factors: clear policy supervision, in-depth institutional participation and technological innovation. 1. The United States may introduce a comprehensive crypto bill, and global regulatory coordination (such as the EU MiCA) will enhance the legitimacy of the industry; 2. Institutional funds will enter large-scale through compliant products such as Bitcoin and Ethereum ETFs, and exchanges such as Binance, OKX, Huobi, Gate.io and Coinbase will serve as core infrastructure to undertake institutional traffic.

Entering 2025, the cryptocurrency market is standing at a critical crossroads, and its future trend will be deeply influenced by global policies and regulations, institutional funding entry and key technological innovation. This article will analyze these three core driving forces in depth and provide investors and observers with a clear framework to predict market dynamics.

Mainstream Bitcoin Exchanges in 2025:

Ouyi okx :

Binance binance:

Huobi htx:

Policy and regulation: From uncertainty to clarity

The evolution of the regulatory environment is the primary factor affecting market confidence in 2025. In the past, the market grew wildly in the gray areas of regulation, and now major economies around the world are accelerating the construction of clear regulatory frameworks, which is both a challenge and an opportunity.

The weather vane of the US market

The direction of the United States' policy is crucial. With the successful launch of Bitcoin spot ETFs, the market has new expectations for the attitude of regulators (such as the SEC). In 2025, the market will closely monitor whether the United States will introduce a more comprehensive cryptocurrency bill, clarifying the legal status of digital assets, the compliance path of exchanges, and investor protection measures. A clearer regulatory environment will clear the barriers for large-scale traditional fund entry.

Global regulatory collaboration

The EU's Crypto Asset Market Regulation (MiCA) has come into effect in full, providing unified standards for regional markets. It is expected that in 2025, more countries and regions (such as Hong Kong, Singapore, and the UAE) will further improve or implement similar regulatory frameworks. This global regulatory synergy trend will help reduce arbitrage space and improve the legitimacy and maturity of the entire industry.

Institutional admission: From testing the waters to in-depth participation

If the last bull market was driven by retail investors, the market growth potential in 2025 will depend more on the in-depth participation of institutional capital. The entry of institutions not only brings huge amounts of funds, but also professional investment strategies and risk management models.

Continuation and expansion of ETF effect

The success of Bitcoin spot ETFs has proved the strong ability of traditional financial channels to attract money on crypto assets. In 2025, the market focus will turn to whether spot ETFs in Ethereum and other mainstream cryptocurrencies will be approved. Once more compliant investment products are released, it will open the door to more conservative institutional investors such as pension funds and sovereign wealth funds.

Key infrastructure platforms

Institutional investors need a safe, compliant and highly liquid trading platform. As the core infrastructure of the market, the following exchanges play a crucial role in undertaking institutional traffic:

1. Binance

As the exchange with the largest trading volume in the world, Binance's compliance process and institutional-level services (such as custody and bulk trading) are industry trends. Its global liquidity depth is crucial for institutions that need to efficiently execute large orders.

2. Ouyi (OKX)

Known for its powerful technical architecture and rich product line, OKX provides professional traders and institutions with a high-performance trading engine, unified account system and advanced API interface, and is one of the ideal platforms for institutions to conduct complex trading strategies.

3. Huobi (HTX)

With its long history in the Asian market and extensive user base, Huobi still occupies an important position in the global liquidity network. Its measures to launch stablecoins and new assets deserve institutional attention.

4. Gate.io

Known for its massive currency selection, it provides a broad choice for institutions seeking diversified allocation and early-stage project investment opportunities. Its continued investment in asset security and risk control has also increased its attractiveness to institutions.

5. Coinbase

As a compliant exchange listed in the United States, Coinbase is the main portal for North American institutional funds to enter the crypto market. Its strong brand reputation and compliance status make it the preferred partner for many organizations.

Technological innovation: driving intrinsic value growth

The long-term and healthy development of the market ultimately depends on the practical application value brought by technological innovation. In 2025, several major technological narratives will become the core engine driving the growth of the industry's intrinsic value.

Maturity and popularity of Layer 2 network

Ethereum's Layer 2 solutions (such as Arbitrum, Optimism, zkSync) will enter the stage of large-scale application in 2025. Lower transaction fees and faster confirmation speeds will enable decentralized finance (DeFi), games (GameFi) and social applications (SocialFi) to host hundreds of millions of users, truly achieving a leap from concept to practicality.

Tokenization of Real-World Assets (RWA)

Tokenizing real-world assets such as real estate, bonds, and private credit through blockchain is a huge bridge connecting the traditional finance and the crypto world. In 2025, with the improvement of the legal framework and the establishment of technical standards, the RWA track is expected to usher in an explosion, injecting trillions of dollars in high-quality collateral and liquidity into the DeFi protocol.

The convergence of artificial intelligence (AI) and encryption

The combination of AI and encryption is giving birth to new possibilities. Whether it is using AI to optimize DeFi trading strategies, create a decentralized AI model training network, or interacting with smart contracts through AI-driven agents (agents), this cross-field indicates huge innovation potential and is expected to become a new hot spot in the market in 2025.

The above is the detailed content of 2025 Cryptocurrency Market Outlook: How do policies, institutions and technological innovations affect trends?. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undress AI Tool

Undress images for free

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Clothoff.io

AI clothes remover

Video Face Swap

Swap faces in any video effortlessly with our completely free AI face swap tool!

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

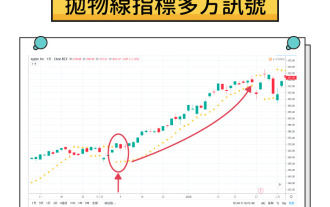

What is a parabolic SAR indicator? How does SAR indicator work? Comprehensive introduction to SAR indicators

Aug 06, 2025 pm 08:12 PM

What is a parabolic SAR indicator? How does SAR indicator work? Comprehensive introduction to SAR indicators

Aug 06, 2025 pm 08:12 PM

Contents Understand the mechanism of parabola SAR The working principle of parabola SAR calculation method and acceleration factor visual representation on trading charts Application of parabola SAR in cryptocurrency markets1. Identify potential trend reversal 2. Determine the best entry and exit points3. Set dynamic stop loss order case study: hypothetical ETH trading scenario Parabola SAR trading signals and interpretation Based on parabola SAR trading execution Combining parabola SAR with other indicators1. Use moving averages to confirm trend 2. Relative strength indicator (RSI) for momentum analysis3. Bollinger bands for volatility analysis Advantages of parabola SAR and limitations Advantages of parabola SAR

Binance official website only entrance correct address

Aug 06, 2025 pm 11:33 PM

Binance official website only entrance correct address

Aug 06, 2025 pm 11:33 PM

The only correct entry for Binance official website is the official website with a domain name ending with .com, and there are no extra symbols or subdirectories; 2. To verify the authenticity of the official website, you need to check the SSL certificate, check the domain name through official social media, and be wary of phishing links; 3. Common fraud methods include counterfeit domain names, false customer service inducement and APP download traps through non-official channels; 4. Safe access suggestions include enabling two-factor verification, using browser bookmarks to save the official website address and regularly check the device authorization status to ensure the security and integrity of the account.

Cardano (ADA Coin) price forecast: 2025, 2026 and beyond

Aug 06, 2025 pm 07:33 PM

Cardano (ADA Coin) price forecast: 2025, 2026 and beyond

Aug 06, 2025 pm 07:33 PM

Directory What is Cardano? Key Features of Cardano How does Cardano work? Why Cardano deserves to consider price and market performance history 2025 ADA forecast 2025, 2026 and 2027 Price forecasts 2040 and 2030 ADA price forecast Factors affecting ADA costs Chart analysis and technical outlook Cardano Forecast Table: Key points summary As an important force in the cryptocurrency industry, Cardano (ADA) provides cutting-edge blockchain solutions with a focus on sustainability, scalability and security. Cardano is co-founder of Ethereum.

A detailed explanation of triangle arbitrage in the cryptocurrency market

Aug 06, 2025 pm 08:24 PM

A detailed explanation of triangle arbitrage in the cryptocurrency market

Aug 06, 2025 pm 08:24 PM

Table of Contents Triangle Arbitrage Introduction Cryptocurrency Triangle Arbitrage Mechanism Challenges: Identifying Opportunities Risks, Ethics and Regulatory Considerations Conclusion Triangle Arbitrage Introduction Triangle Arbitrage is a trading strategy aimed at capturing the temporary price mismatch between the three related assets, thereby achieving nearly risk-free returns. This strategy forms a closed loop by conducting continuous trading between three related trading pairs (such as BTC/ETH, ETH/USDT, USDT/BTC), and takes advantage of temporary imbalance in the exchange rate to make profits. Its essence comes from the basic principle of arbitrage, that is, price correction is carried out when market efficiency is insufficient, while the triangle form increases the complexity of operations through multiple steps of trading. Cryptocurrencies provide more frequent opportunities for triangle arbitrage compared to traditional forex markets. Forex market due to

What is open position in cryptocurrency? Comprehensive Guide to Open Positions

Aug 06, 2025 pm 08:27 PM

What is open position in cryptocurrency? Comprehensive Guide to Open Positions

Aug 06, 2025 pm 08:27 PM

Directory What is open position? Understand the importance of open positions in cryptocurrencies Where can I find open positions data? The role of open positions in market trends Comparison of open positions and trading volume Definition: Their indicative significance: Relationship: Market trend: Limitations of open positions Summary Thinking of common questions about open positions in cryptocurrencies 1. How to use open positions to confirm market trends? 2. What is the difference between open position volume and trading volume? 3. Is it always better to have higher open positions? 4. What is the role of open positions in evaluating market liquidity? 5. How to distinguish

Solana (SOL Coin) Price Forecast: 2025-2030 and Future Outlook

Aug 06, 2025 pm 08:42 PM

Solana (SOL Coin) Price Forecast: 2025-2030 and Future Outlook

Aug 06, 2025 pm 08:42 PM

Table of Contents Solana's Price History and Important Market Data Important Data in Solana Price Chart: 2025 Solana Price Forecast: Optimistic 2026 Solana Price Forecast: Maintain Trend 2026 Solana Price Forecast: 2030 Solana Long-term Price Forecast: Top Blockchain? What affects the forecast of sun prices? Scalability and Solana: Competitive Advantages Should you invest in Solana in the next few years? Conclusion: Solana's price prospects Conclusion: Solana has its excellent scalability, low transaction costs and high efficiency

Which blockchain does USDC stablecoin belong to? Which mainstream link networks do it support?

Aug 06, 2025 pm 10:45 PM

Which blockchain does USDC stablecoin belong to? Which mainstream link networks do it support?

Aug 06, 2025 pm 10:45 PM

USDC was first deployed on the Ethereum main network and adopted the ERC-20 standard. It currently supports more than ten mainstream blockchain networks including 1. Ethereum, 2. Polygon, 3. Arbitrum, 4. Optimism, 5. Solana, 6. Avalanche, 7. Base, 8. Stellar, 9. Tron, 10. Near, 11. Algorand, 12. Flow, etc. Each chain version is suitable for different scenarios. Users need to confirm the contract address through the Circle official website to ensure safe use.

Blockchain browser: a must-have tool for querying digital currency transaction information

Aug 06, 2025 pm 11:27 PM

Blockchain browser: a must-have tool for querying digital currency transaction information

Aug 06, 2025 pm 11:27 PM

Blockchain browser is a necessary tool for querying digital currency transaction information. It provides a visual interface for blockchain data, so that users can query transaction hash, block height, address balance and other information; its working principle includes data synchronization, parsing, indexing and user interface display; core functions cover querying transaction details, block information, address balance, token data and network status; when using it, you need to obtain TxID and select the corresponding blockchain browser such as Etherscan or Blockchain.com to search; query address information to view balance and transaction history by entering the address; mainstream browsers include Bitcoin's Blockchain.com, Ethereum's Etherscan.io, B