web3.0

web3.0

What is a cryptocurrency exchange? How does a trading platform ensure the security of funds? Will they dominate the market?

What is a cryptocurrency exchange? How does a trading platform ensure the security of funds? Will they dominate the market?

What is a cryptocurrency exchange? How does a trading platform ensure the security of funds? Will they dominate the market?

Jul 24, 2025 am 06:42 AMDigital asset exchanges are online platforms that allow users to trade various types of digital asset. They play a crucial role in the entire ecosystem, just like stock exchanges in the traditional financial world. The core functions of these platforms are to provide liquidity, discover prices and match transactions. Users are generally concerned about their funding security mechanisms and their position in the future market structure. With the development of technology, the two modes of centralization and decentralization coexist, jointly shaping the future of the market.

1. Analysis of exchange-related platforms

1. Binance: a world-renowned comprehensive digital asset service platform, providing a wide range of transaction options and ecosystem applications. The official address is ? .

2. OK: A well-known platform with a compliance license in Asia is known for its friendly user interface and compliance, and is the first choice for many new users to enter the field. The official address is ? .

3. HTX: One of the long-standing platforms, known for its high security standards and support for a variety of fiat currencies. The official address is ? .

2. Web3: Decentralized Internet based on blockchain

1. Web3 is known as the next generation of the Internet. It is based on blockchain technology and aims to build a more open, transparent and user-autonomous decentralized network.

2. Unlike traditional Internet platforms, the core concept of Web3 is user data sovereignty , where users can truly own and control their digital identities and assets instead of entrusting them to third-party companies.

3. This decentralized feature fundamentally changes the way trust is established and also provides possibilities for higher security transaction models.

3. Smart contract: The core technology of Web3

1. Smart contracts are the cornerstone of Web3. It is an automated computer program where contract terms are written directly into code and deployed on the blockchain.

2. When the preset conditions are met, the smart contract will automatically perform the corresponding operations. The entire process does not require manual intervention, and it is open and transparent and cannot be tampered with.

3. It builds a trust mechanism of "code is law", which greatly reduces the risks of counterparty parties and is a technical guarantee for the safe operation of decentralized finance (DeFi) and decentralized exchanges (DEX).

4. Decentralized application (DApp): The main application form of Web3

1. Decentralized applications (DApps) are applications running on blockchain or peer-to-peer networks, and their backend code (mainly smart contracts) is open source and run independently.

2. Decentralized exchanges (DEXs) are a typical DApp. Users directly interact with smart contracts by connecting their own digital asset holding tools to complete asset redemption.

3. In this model, the user's assets are always kept by themselves and cannot be touched by the platform, thus ensuring the security of funds structurally. This is in sharp contrast to the centralized model of requiring assets to be deposited into platform accounts. In the future, the market is likely to be a situation where centralized and decentralized platforms coexist for a long time and complement each other.

The above is the detailed content of What is a cryptocurrency exchange? How does a trading platform ensure the security of funds? Will they dominate the market?. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undress AI Tool

Undress images for free

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Clothoff.io

AI clothes remover

Video Face Swap

Swap faces in any video effortlessly with our completely free AI face swap tool!

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

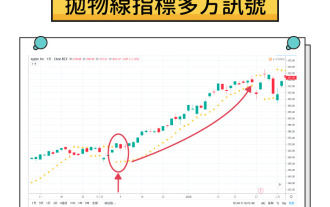

What is a parabolic SAR indicator? How does SAR indicator work? Comprehensive introduction to SAR indicators

Aug 06, 2025 pm 08:12 PM

What is a parabolic SAR indicator? How does SAR indicator work? Comprehensive introduction to SAR indicators

Aug 06, 2025 pm 08:12 PM

Contents Understand the mechanism of parabola SAR The working principle of parabola SAR calculation method and acceleration factor visual representation on trading charts Application of parabola SAR in cryptocurrency markets1. Identify potential trend reversal 2. Determine the best entry and exit points3. Set dynamic stop loss order case study: hypothetical ETH trading scenario Parabola SAR trading signals and interpretation Based on parabola SAR trading execution Combining parabola SAR with other indicators1. Use moving averages to confirm trend 2. Relative strength indicator (RSI) for momentum analysis3. Bollinger bands for volatility analysis Advantages of parabola SAR and limitations Advantages of parabola SAR

Binance official website only entrance correct address

Aug 06, 2025 pm 11:33 PM

Binance official website only entrance correct address

Aug 06, 2025 pm 11:33 PM

The only correct entry for Binance official website is the official website with a domain name ending with .com, and there are no extra symbols or subdirectories; 2. To verify the authenticity of the official website, you need to check the SSL certificate, check the domain name through official social media, and be wary of phishing links; 3. Common fraud methods include counterfeit domain names, false customer service inducement and APP download traps through non-official channels; 4. Safe access suggestions include enabling two-factor verification, using browser bookmarks to save the official website address and regularly check the device authorization status to ensure the security and integrity of the account.

Cardano (ADA Coin) price forecast: 2025, 2026 and beyond

Aug 06, 2025 pm 07:33 PM

Cardano (ADA Coin) price forecast: 2025, 2026 and beyond

Aug 06, 2025 pm 07:33 PM

Directory What is Cardano? Key Features of Cardano How does Cardano work? Why Cardano deserves to consider price and market performance history 2025 ADA forecast 2025, 2026 and 2027 Price forecasts 2040 and 2030 ADA price forecast Factors affecting ADA costs Chart analysis and technical outlook Cardano Forecast Table: Key points summary As an important force in the cryptocurrency industry, Cardano (ADA) provides cutting-edge blockchain solutions with a focus on sustainability, scalability and security. Cardano is co-founder of Ethereum.

Solana (SOL Coin) Price Forecast: 2025-2030 and Future Outlook

Aug 06, 2025 pm 08:42 PM

Solana (SOL Coin) Price Forecast: 2025-2030 and Future Outlook

Aug 06, 2025 pm 08:42 PM

Table of Contents Solana's Price History and Important Market Data Important Data in Solana Price Chart: 2025 Solana Price Forecast: Optimistic 2026 Solana Price Forecast: Maintain Trend 2026 Solana Price Forecast: 2030 Solana Long-term Price Forecast: Top Blockchain? What affects the forecast of sun prices? Scalability and Solana: Competitive Advantages Should you invest in Solana in the next few years? Conclusion: Solana's price prospects Conclusion: Solana has its excellent scalability, low transaction costs and high efficiency

Which blockchain does USDC stablecoin belong to? Which mainstream link networks do it support?

Aug 06, 2025 pm 10:45 PM

Which blockchain does USDC stablecoin belong to? Which mainstream link networks do it support?

Aug 06, 2025 pm 10:45 PM

USDC was first deployed on the Ethereum main network and adopted the ERC-20 standard. It currently supports more than ten mainstream blockchain networks including 1. Ethereum, 2. Polygon, 3. Arbitrum, 4. Optimism, 5. Solana, 6. Avalanche, 7. Base, 8. Stellar, 9. Tron, 10. Near, 11. Algorand, 12. Flow, etc. Each chain version is suitable for different scenarios. Users need to confirm the contract address through the Circle official website to ensure safe use.

Blockchain browser: a must-have tool for querying digital currency transaction information

Aug 06, 2025 pm 11:27 PM

Blockchain browser: a must-have tool for querying digital currency transaction information

Aug 06, 2025 pm 11:27 PM

Blockchain browser is a necessary tool for querying digital currency transaction information. It provides a visual interface for blockchain data, so that users can query transaction hash, block height, address balance and other information; its working principle includes data synchronization, parsing, indexing and user interface display; core functions cover querying transaction details, block information, address balance, token data and network status; when using it, you need to obtain TxID and select the corresponding blockchain browser such as Etherscan or Blockchain.com to search; query address information to view balance and transaction history by entering the address; mainstream browsers include Bitcoin's Blockchain.com, Ethereum's Etherscan.io, B

A detailed explanation of triangle arbitrage in the cryptocurrency market

Aug 06, 2025 pm 08:24 PM

A detailed explanation of triangle arbitrage in the cryptocurrency market

Aug 06, 2025 pm 08:24 PM

Table of Contents Triangle Arbitrage Introduction Cryptocurrency Triangle Arbitrage Mechanism Challenges: Identifying Opportunities Risks, Ethics and Regulatory Considerations Conclusion Triangle Arbitrage Introduction Triangle Arbitrage is a trading strategy aimed at capturing the temporary price mismatch between the three related assets, thereby achieving nearly risk-free returns. This strategy forms a closed loop by conducting continuous trading between three related trading pairs (such as BTC/ETH, ETH/USDT, USDT/BTC), and takes advantage of temporary imbalance in the exchange rate to make profits. Its essence comes from the basic principle of arbitrage, that is, price correction is carried out when market efficiency is insufficient, while the triangle form increases the complexity of operations through multiple steps of trading. Cryptocurrencies provide more frequent opportunities for triangle arbitrage compared to traditional forex markets. Forex market due to

What is open position in cryptocurrency? Comprehensive Guide to Open Positions

Aug 06, 2025 pm 08:27 PM

What is open position in cryptocurrency? Comprehensive Guide to Open Positions

Aug 06, 2025 pm 08:27 PM

Directory What is open position? Understand the importance of open positions in cryptocurrencies Where can I find open positions data? The role of open positions in market trends Comparison of open positions and trading volume Definition: Their indicative significance: Relationship: Market trend: Limitations of open positions Summary Thinking of common questions about open positions in cryptocurrencies 1. How to use open positions to confirm market trends? 2. What is the difference between open position volume and trading volume? 3. Is it always better to have higher open positions? 4. What is the role of open positions in evaluating market liquidity? 5. How to distinguish