How to operate short selling in currency speculation

Apr 17, 2024 am 11:26 AMShorting in the cryptocurrency market refers to predicting a fall in the price of an asset and profiting from selling the asset. Short selling steps: 1. Select an exchange that supports short selling; 2. Financing for short selling; 3. Sell the contract; 4. Monitor the market; 5. Close the position. Be aware of risk management, use of leverage, market volatility and transaction costs.

Operation guide for short selling in currency trading

What is short selling

In the financial market In , shorting refers to the trading strategy of anticipating a fall in the price of an asset and making a profit by selling the asset. In the cryptocurrency market, shorting means predicting that the price of a particular cryptocurrency will fall and making a profit by selling that cryptocurrency.

How to short trade

1. Choose an exchange

Choose a cryptocurrency exchange that supports short trading . These exchanges often offer derivatives markets, such as perpetual contracts, that allow traders to short cryptocurrencies.

2. Financing

Short selling requires borrowed funds because you will be selling cryptocurrency that does not belong to you. Exchanges often offer leverage, which allows you to borrow a certain amount of money to increase the size of your trade.

3. Selling Contracts

In the derivatives market, short selling is achieved by selling contracts. A contract represents a certain amount of cryptocurrency that you promise to sell at a specific price in the future.

4. Monitor the Market

Once you have established a short position, it is crucial to monitor the price of a cryptocurrency. When the price falls, your position will be profitable. On the contrary, when the price rises, you will lose money.

5. Closing a position

You can close a position when you think the price has reached a low point or you want to lock in a profit. This means buying the number of contracts you previously sold to complete the trade.

Notes

- Risk Management: Short selling carries high risks. If prices rise, you could suffer significant losses. Therefore, it is important to manage risk.

- Leverage: Leverage can magnify your profits, but it can also magnify your losses. Use leverage carefully and don't use more than you can afford.

- Market Volatility: The cryptocurrency market is highly volatile. Please be prepared for large price swings and adjust your trading strategy accordingly.

- Transaction Costs: Short selling usually involves fees, such as transaction fees and interest on borrowing money. It's important to consider these costs before going short.

The above is the detailed content of How to operate short selling in currency speculation. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undress AI Tool

Undress images for free

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Clothoff.io

AI clothes remover

Video Face Swap

Swap faces in any video effortlessly with our completely free AI face swap tool!

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

How to download the Binance official app Binance Exchange app download link to get

Aug 04, 2025 pm 11:21 PM

How to download the Binance official app Binance Exchange app download link to get

Aug 04, 2025 pm 11:21 PM

As the internationally leading blockchain digital asset trading platform, Binance provides users with a safe and convenient trading experience. Its official app integrates multiple core functions such as market viewing, asset management, currency trading and fiat currency trading.

Ouyi Exchange APP Android version v6.132.0 Ouyi APP official website download and installation guide 2025

Aug 04, 2025 pm 11:18 PM

Ouyi Exchange APP Android version v6.132.0 Ouyi APP official website download and installation guide 2025

Aug 04, 2025 pm 11:18 PM

OKX is a world-renowned comprehensive digital asset service platform, providing users with diversified products and services including spot, contracts, options, etc. With its smooth operation experience and powerful function integration, its official APP has become a common tool for many digital asset users.

Binance official app download latest link Binance exchange app installation portal

Aug 04, 2025 pm 11:24 PM

Binance official app download latest link Binance exchange app installation portal

Aug 04, 2025 pm 11:24 PM

Binance is a world-renowned digital asset trading platform, providing users with secure, stable and rich cryptocurrency trading services. Its app is simple to design and powerful, supporting a variety of transaction types and asset management tools.

Binance official app latest official website entrance Binance exchange app download address

Aug 04, 2025 pm 11:27 PM

Binance official app latest official website entrance Binance exchange app download address

Aug 04, 2025 pm 11:27 PM

Binance is one of the world's well-known digital asset trading platforms, providing users with safe, stable and convenient cryptocurrency trading services. Through the Binance App, you can view market conditions, buy, sell and asset management anytime, anywhere.

What is the download address of Anbi Exchange app? The latest official download portal of Anbi App

Aug 04, 2025 pm 11:15 PM

What is the download address of Anbi Exchange app? The latest official download portal of Anbi App

Aug 04, 2025 pm 11:15 PM

Anbi Exchange is a world-renowned digital asset trading platform, providing users with secure, stable and convenient cryptocurrency trading services. Through the Anbi App, you can view market conditions, manage digital assets, and conduct transactions of multiple coin pairs anytime, anywhere.

Binance (BINANCE) contract to launch ALL 75x composite index U-standard perpetual contract

Aug 06, 2025 pm 06:48 PM

Binance (BINANCE) contract to launch ALL 75x composite index U-standard perpetual contract

Aug 06, 2025 pm 06:48 PM

Table of Contents About Binance ALL Comprehensive Index About Binance ALL Comprehensive Index Fixed-point adjustment component mechanism The newly launched U-standard perpetual contract with USDT quoted U-standard perpetual contract The Binance Contract is scheduled to officially launch the ALL75 times comprehensive index U-standard perpetual contract at 17:00 on August 6, 2025 (East Eighth District time). About Binance ALL Comprehensive Index Binance Exchange: Official Registration Official Download Binance ALL Comprehensive Index is designed to track the performance of all U-standard perpetual contracts denominated in USDT on the Binance Contract Platform, but the following types of contracts are not included: ETHBTC perpetual contracts quoted using USDC or other stablecoins U-standard delivery contracts All comprehensive index perpetual contracts are permanent

Cardano (ADA Coin) price forecast: 2025, 2026 and beyond

Aug 06, 2025 pm 07:33 PM

Cardano (ADA Coin) price forecast: 2025, 2026 and beyond

Aug 06, 2025 pm 07:33 PM

Directory What is Cardano? Key Features of Cardano How does Cardano work? Why Cardano deserves to consider price and market performance history 2025 ADA forecast 2025, 2026 and 2027 Price forecasts 2040 and 2030 ADA price forecast Factors affecting ADA costs Chart analysis and technical outlook Cardano Forecast Table: Key points summary As an important force in the cryptocurrency industry, Cardano (ADA) provides cutting-edge blockchain solutions with a focus on sustainability, scalability and security. Cardano is co-founder of Ethereum.

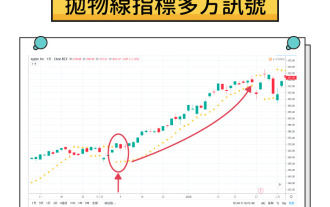

What is a parabolic SAR indicator? How does SAR indicator work? Comprehensive introduction to SAR indicators

Aug 06, 2025 pm 08:12 PM

What is a parabolic SAR indicator? How does SAR indicator work? Comprehensive introduction to SAR indicators

Aug 06, 2025 pm 08:12 PM

Contents Understand the mechanism of parabola SAR The working principle of parabola SAR calculation method and acceleration factor visual representation on trading charts Application of parabola SAR in cryptocurrency markets1. Identify potential trend reversal 2. Determine the best entry and exit points3. Set dynamic stop loss order case study: hypothetical ETH trading scenario Parabola SAR trading signals and interpretation Based on parabola SAR trading execution Combining parabola SAR with other indicators1. Use moving averages to confirm trend 2. Relative strength indicator (RSI) for momentum analysis3. Bollinger bands for volatility analysis Advantages of parabola SAR and limitations Advantages of parabola SAR