What does Ethereum staking mean? How to calculate the income?

Jul 02, 2025 pm 11:06 PMAfter major upgrades, the Ethereum network has transitioned from the original Proof-of-Work (PoW) mechanism to the Proof-of-Stake (PoS) mechanism. The core of this transformation is how the network reaches consensus, validates transactions and creates new blocks. Under the PoS system, the role of miners is replaced by validators. Verifiers participate in the consensus process of the network by "staking" a certain amount of Ethereum (ETH).

Staking is a way for Ethereum holders to support network operation. By locking their ETH, they have a chance to be selected to verify new transaction blocks. Blocks that are successfully verified and added to the chain reward validators, which constitute the main source of staking income. This mechanism encourages coin holders to actively participate in maintaining network security and decentralization .

What is Ethereum staking?

1. Ethereum staking involves depositing Ethereum into smart contracts to support the network's proof-of-stake consensus mechanism.

2. The purpose of pledge is to make these Ethereum the basis for network validators to participate in block proposals and proofs.

3. To become a complete validator node, you need to stake 32 ETH . ETH less than this amount can be participated by staking pools and other means.

4. The validator is responsible for checking the validity of transactions and packaging them into new blocks, or proofing the blocks proposed by other validators.

5. The pledged ETH is usually locked for a period of time and cannot be taken out immediately, which ensures that the verifier has financial incentives to act honestly.

Validator's workflow

1. The validator software will continuously monitor transactions and blocks on the network.

2. According to the proof of stake algorithm, the verifier has the opportunity to be selected to propose new blocks or to prove existing blocks.

3. The validator of the proposed block needs to collect pending transactions, verify their validity, and package them into a new block.

4. Attestation of blocks is a more common task. Verifiers confirm that a block is valid, which is a key step in building consensus.

5. Verifiers need to maintain high availability and proper configuration of their node software in order to perform assigned tasks in a timely manner.

How to calculate the pledge income?

1. The yield on Ethereum pledge is a dynamically changing value , not a fixed interest rate.

2. The benefits mainly come from the proposed rewards for new blocks and the proof rewards for proposed blocks.

3. The total pledge of the network is a key factor affecting the rate of return. The higher the total pledge, the lower the annualized rate of return allocated to each validator.

4. The profit calculation also depends on the performance of the validator, including its online time (uptime) and the frequency of successful completion of the proposed/proof tasks.

5. Verifiers may suffer fines for offline or misconduct (such as double signatures), which will reduce or offset part of the gains. Misconduct may even lead to "slashing" and loss of large amounts of pledged ETH.

Factors affecting pledge income

1. Total online pledge : This is the most important factor that determines the basic annualized rate of return. The agreement will adjust the reward issuance rate based on the total pledge amount.

2. Verifier performance : The online rate of the verifier, whether the proof is submitted promptly and correctly, and whether the blocks that are successfully proposed are directly affected by the specific number of rewards they receive.

3. Penalties : Verifiers will suffer minor fines when offline. This is a kind of "inactive punishment".

4. Slashing : Malicious behavior or serious operational errors (such as signing two different blocks at the same height) will cause some ETH pledged by the verifier to be confiscated, which is far higher than ordinary fines.

5. Transaction Fees : In addition to the rewards issued by the agreement, the validator (more precisely the block proposer) can also obtain the priority fees (tips) incurred by the exchange in its proposed block.

The above is the detailed content of What does Ethereum staking mean? How to calculate the income?. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undress AI Tool

Undress images for free

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Clothoff.io

AI clothes remover

Video Face Swap

Swap faces in any video effortlessly with our completely free AI face swap tool!

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

How to download the Binance official app Binance Exchange app download link to get

Aug 04, 2025 pm 11:21 PM

How to download the Binance official app Binance Exchange app download link to get

Aug 04, 2025 pm 11:21 PM

As the internationally leading blockchain digital asset trading platform, Binance provides users with a safe and convenient trading experience. Its official app integrates multiple core functions such as market viewing, asset management, currency trading and fiat currency trading.

Binance official app download latest link Binance exchange app installation portal

Aug 04, 2025 pm 11:24 PM

Binance official app download latest link Binance exchange app installation portal

Aug 04, 2025 pm 11:24 PM

Binance is a world-renowned digital asset trading platform, providing users with secure, stable and rich cryptocurrency trading services. Its app is simple to design and powerful, supporting a variety of transaction types and asset management tools.

Ouyi Exchange APP Android version v6.132.0 Ouyi APP official website download and installation guide 2025

Aug 04, 2025 pm 11:18 PM

Ouyi Exchange APP Android version v6.132.0 Ouyi APP official website download and installation guide 2025

Aug 04, 2025 pm 11:18 PM

OKX is a world-renowned comprehensive digital asset service platform, providing users with diversified products and services including spot, contracts, options, etc. With its smooth operation experience and powerful function integration, its official APP has become a common tool for many digital asset users.

Binance official app latest official website entrance Binance exchange app download address

Aug 04, 2025 pm 11:27 PM

Binance official app latest official website entrance Binance exchange app download address

Aug 04, 2025 pm 11:27 PM

Binance is one of the world's well-known digital asset trading platforms, providing users with safe, stable and convenient cryptocurrency trading services. Through the Binance App, you can view market conditions, buy, sell and asset management anytime, anywhere.

Which blockchain does USDC stablecoin belong to? Which mainstream link networks do it support?

Aug 06, 2025 pm 10:45 PM

Which blockchain does USDC stablecoin belong to? Which mainstream link networks do it support?

Aug 06, 2025 pm 10:45 PM

USDC was first deployed on the Ethereum main network and adopted the ERC-20 standard. It currently supports more than ten mainstream blockchain networks including 1. Ethereum, 2. Polygon, 3. Arbitrum, 4. Optimism, 5. Solana, 6. Avalanche, 7. Base, 8. Stellar, 9. Tron, 10. Near, 11. Algorand, 12. Flow, etc. Each chain version is suitable for different scenarios. Users need to confirm the contract address through the Circle official website to ensure safe use.

Binance (BINANCE) contract to launch ALL 75x composite index U-standard perpetual contract

Aug 06, 2025 pm 06:48 PM

Binance (BINANCE) contract to launch ALL 75x composite index U-standard perpetual contract

Aug 06, 2025 pm 06:48 PM

Table of Contents About Binance ALL Comprehensive Index About Binance ALL Comprehensive Index Fixed-point adjustment component mechanism The newly launched U-standard perpetual contract with USDT quoted U-standard perpetual contract The Binance Contract is scheduled to officially launch the ALL75 times comprehensive index U-standard perpetual contract at 17:00 on August 6, 2025 (East Eighth District time). About Binance ALL Comprehensive Index Binance Exchange: Official Registration Official Download Binance ALL Comprehensive Index is designed to track the performance of all U-standard perpetual contracts denominated in USDT on the Binance Contract Platform, but the following types of contracts are not included: ETHBTC perpetual contracts quoted using USDC or other stablecoins U-standard delivery contracts All comprehensive index perpetual contracts are permanent

Cardano (ADA Coin) price forecast: 2025, 2026 and beyond

Aug 06, 2025 pm 07:33 PM

Cardano (ADA Coin) price forecast: 2025, 2026 and beyond

Aug 06, 2025 pm 07:33 PM

Directory What is Cardano? Key Features of Cardano How does Cardano work? Why Cardano deserves to consider price and market performance history 2025 ADA forecast 2025, 2026 and 2027 Price forecasts 2040 and 2030 ADA price forecast Factors affecting ADA costs Chart analysis and technical outlook Cardano Forecast Table: Key points summary As an important force in the cryptocurrency industry, Cardano (ADA) provides cutting-edge blockchain solutions with a focus on sustainability, scalability and security. Cardano is co-founder of Ethereum.

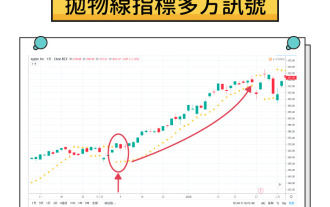

What is a parabolic SAR indicator? How does SAR indicator work? Comprehensive introduction to SAR indicators

Aug 06, 2025 pm 08:12 PM

What is a parabolic SAR indicator? How does SAR indicator work? Comprehensive introduction to SAR indicators

Aug 06, 2025 pm 08:12 PM

Contents Understand the mechanism of parabola SAR The working principle of parabola SAR calculation method and acceleration factor visual representation on trading charts Application of parabola SAR in cryptocurrency markets1. Identify potential trend reversal 2. Determine the best entry and exit points3. Set dynamic stop loss order case study: hypothetical ETH trading scenario Parabola SAR trading signals and interpretation Based on parabola SAR trading execution Combining parabola SAR with other indicators1. Use moving averages to confirm trend 2. Relative strength indicator (RSI) for momentum analysis3. Bollinger bands for volatility analysis Advantages of parabola SAR and limitations Advantages of parabola SAR