Understand in one article: What does stablecoin mean

Jul 15, 2025 pm 07:12 PMStable coins are cryptocurrencies with stable value. They maintain price stability by anchoring assets such as the US dollar to solve the volatility problem of crypto markets. Its core role includes providing a medium of transaction, a store of value and an account unit, supporting daily payment and safe-haven needs. There are three main types: 1. Frax (such as USDT and USDC), with a simple mechanism but dependent on centralized institutions; 2. Crypto Assets (such as DAI), with a high degree of decentralization but requiring over-collateralization; 3. Algorithm (such as Frax), which relies on smart contracts to adjust supply, but has a high risk.

In the cryptocurrency world with severe price fluctuations, stablecoins provide a relatively calm harbor, whose value is linked to stable assets such as the US dollar, effectively connecting the traditional financial and digital assets fields. This article will explain in detail what stablecoins are, how they work, and why they play a crucial role in the crypto ecosystem.

Stablecoin Exchange in 2025:

Ouyi official website direct access :

Binance official website direct:

Huobi official website direct:

What is a stablecoin?

Stablecoin is a special cryptocurrency designed to maintain its value stability. Unlike cryptocurrencies with drastic price fluctuations such as Bitcoin or Ethereum, stablecoins minimize price fluctuations by anchoring value with some kind of "stable" asset. The most common anchors are fiat currencies such as the US dollar or the euro, but they can also be commodities such as gold.

The core value of stablecoins is that they not only possess the technical advantages of cryptocurrencies (such as fast transfers, borderlessness, programmability), but also avoid the shortcomings of its price instability, making it an ideal medium of transactions, store of value and accountancy units in the crypto market.

Why do we need stablecoins?

Imagine if you buy a cup of coffee with Bitcoin, it might be worth $5 this minute, and the next minute it becomes $4 or $6. This uncertainty makes it difficult for cryptocurrencies to be used in daily payments and commercial activities. Stablecoins solve this core pain point.

For cryptocurrency traders, stablecoins are a key hedge tool. When the market falls, traders can convert other cryptocurrencies they hold into stablecoins to lock in profits or avoid further losses without withdrawing funds into the traditional banking system. This greatly improves the liquidity and trading efficiency of funds.

The main types of stablecoins

Stablecoins maintain their value anchorage primarily through three different mechanisms. Understanding their differences is essential to assessing their reliability.

1. Fiat-Collateralized

This is the most common and easiest to understand stablecoin. It works very directly: for every unit of stablecoin issued by the issuer, it deposits fiat currency of equivalent value (such as 1 USD) in its bank reserves. This means that behind every stablecoin is real fiat currency as value support.

Representative items: Tether (USDT), USD Coin (USDC).

Advantages: The mechanism is simple, the value is stable, and it is easy to be understood and accepted by users.

Disadvantages: Relying on centralized institutions for reserve management and auditing, there are trust risks and regulatory uncertainties. This type of mainstream stablecoins has excellent liquidity on major exchanges, such as Binance, OKX, Huobi (HTX) and Gate.io, all use it as basic trading pairs.

2. Crypto-Collateralized

These stablecoins use other cryptocurrencies (such as Ethereum) as collateral. To cope with the risk of price fluctuations in the collateral itself, the system usually requires "over-collateralization". For example, a user may need to stake $150 worth of Ethereum to mint a $100 stablecoin. This extra cushion can absorb the decline in collateral prices, thus protecting the value anchor of the stablecoin.

Representative Project: MakerDAO (DAI).

Advantages: More decentralized, all collateral and clearing rules are executed on-chain through smart contracts, with high transparency.

Disadvantages: The mechanism is more complex, and when collateral prices plummet, they may still face the risk of decoupling.

3. Algorithmic Stablecoin (Algorithmic)

Algorithm stablecoins are the most complex and cutting-edge of the three. Instead of relying on any direct collateral assets, it automatically regulates the supply of tokens on the market through a complex set of algorithms and smart contracts, thus maintaining its price stability. When the price of a stablecoin is higher than the anchor value, the system will issue additional tokens to lower the price; when the price is lower than the anchor value, the tokens will be repurchased or destroyed to increase the price.

Representative projects: There was once UST (TerraUSD), and the existing Frax (partial algorithm).

Advantages: Really decentralized and high capital efficiency.

Disadvantages: Extremely fragile, extremely dependent on market confidence and algorithm design. There have been failure cases of spiral collapse due to design defects in history, and the risks are extremely high.

The role and future of stablecoins

Stablecoins have become the cornerstone of the field of decentralized finance (DeFi), with almost all activities using stablecoins as the core settlement unit. At the same time, it also provides traditional enterprises and individuals with a low-cost and efficient cross-border payment solution, demonstrating its huge potential in the future financial system.

The above is the detailed content of Understand in one article: What does stablecoin mean. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undress AI Tool

Undress images for free

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Clothoff.io

AI clothes remover

Video Face Swap

Swap faces in any video effortlessly with our completely free AI face swap tool!

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

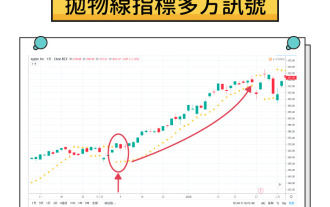

What is a parabolic SAR indicator? How does SAR indicator work? Comprehensive introduction to SAR indicators

Aug 06, 2025 pm 08:12 PM

What is a parabolic SAR indicator? How does SAR indicator work? Comprehensive introduction to SAR indicators

Aug 06, 2025 pm 08:12 PM

Contents Understand the mechanism of parabola SAR The working principle of parabola SAR calculation method and acceleration factor visual representation on trading charts Application of parabola SAR in cryptocurrency markets1. Identify potential trend reversal 2. Determine the best entry and exit points3. Set dynamic stop loss order case study: hypothetical ETH trading scenario Parabola SAR trading signals and interpretation Based on parabola SAR trading execution Combining parabola SAR with other indicators1. Use moving averages to confirm trend 2. Relative strength indicator (RSI) for momentum analysis3. Bollinger bands for volatility analysis Advantages of parabola SAR and limitations Advantages of parabola SAR

Binance official website only entrance correct address

Aug 06, 2025 pm 11:33 PM

Binance official website only entrance correct address

Aug 06, 2025 pm 11:33 PM

The only correct entry for Binance official website is the official website with a domain name ending with .com, and there are no extra symbols or subdirectories; 2. To verify the authenticity of the official website, you need to check the SSL certificate, check the domain name through official social media, and be wary of phishing links; 3. Common fraud methods include counterfeit domain names, false customer service inducement and APP download traps through non-official channels; 4. Safe access suggestions include enabling two-factor verification, using browser bookmarks to save the official website address and regularly check the device authorization status to ensure the security and integrity of the account.

Cardano (ADA Coin) price forecast: 2025, 2026 and beyond

Aug 06, 2025 pm 07:33 PM

Cardano (ADA Coin) price forecast: 2025, 2026 and beyond

Aug 06, 2025 pm 07:33 PM

Directory What is Cardano? Key Features of Cardano How does Cardano work? Why Cardano deserves to consider price and market performance history 2025 ADA forecast 2025, 2026 and 2027 Price forecasts 2040 and 2030 ADA price forecast Factors affecting ADA costs Chart analysis and technical outlook Cardano Forecast Table: Key points summary As an important force in the cryptocurrency industry, Cardano (ADA) provides cutting-edge blockchain solutions with a focus on sustainability, scalability and security. Cardano is co-founder of Ethereum.

Solana (SOL Coin) Price Forecast: 2025-2030 and Future Outlook

Aug 06, 2025 pm 08:42 PM

Solana (SOL Coin) Price Forecast: 2025-2030 and Future Outlook

Aug 06, 2025 pm 08:42 PM

Table of Contents Solana's Price History and Important Market Data Important Data in Solana Price Chart: 2025 Solana Price Forecast: Optimistic 2026 Solana Price Forecast: Maintain Trend 2026 Solana Price Forecast: 2030 Solana Long-term Price Forecast: Top Blockchain? What affects the forecast of sun prices? Scalability and Solana: Competitive Advantages Should you invest in Solana in the next few years? Conclusion: Solana's price prospects Conclusion: Solana has its excellent scalability, low transaction costs and high efficiency

Which blockchain does USDC stablecoin belong to? Which mainstream link networks do it support?

Aug 06, 2025 pm 10:45 PM

Which blockchain does USDC stablecoin belong to? Which mainstream link networks do it support?

Aug 06, 2025 pm 10:45 PM

USDC was first deployed on the Ethereum main network and adopted the ERC-20 standard. It currently supports more than ten mainstream blockchain networks including 1. Ethereum, 2. Polygon, 3. Arbitrum, 4. Optimism, 5. Solana, 6. Avalanche, 7. Base, 8. Stellar, 9. Tron, 10. Near, 11. Algorand, 12. Flow, etc. Each chain version is suitable for different scenarios. Users need to confirm the contract address through the Circle official website to ensure safe use.

Blockchain browser: a must-have tool for querying digital currency transaction information

Aug 06, 2025 pm 11:27 PM

Blockchain browser: a must-have tool for querying digital currency transaction information

Aug 06, 2025 pm 11:27 PM

Blockchain browser is a necessary tool for querying digital currency transaction information. It provides a visual interface for blockchain data, so that users can query transaction hash, block height, address balance and other information; its working principle includes data synchronization, parsing, indexing and user interface display; core functions cover querying transaction details, block information, address balance, token data and network status; when using it, you need to obtain TxID and select the corresponding blockchain browser such as Etherscan or Blockchain.com to search; query address information to view balance and transaction history by entering the address; mainstream browsers include Bitcoin's Blockchain.com, Ethereum's Etherscan.io, B

Binance Exchange Official Website Portal Binance Exchange App Official Mobile Version Portal

Aug 06, 2025 pm 11:30 PM

Binance Exchange Official Website Portal Binance Exchange App Official Mobile Version Portal

Aug 06, 2025 pm 11:30 PM

Founded in 2017 by Zhao Changpeng, Binance is the world's leading cryptocurrency trading platform, known for its high liquidity, low transaction rates and rich trading pairs. 1. The official website entrance is: [adid]fbd7939d674997cdb4692d34de8633c4[/adid]. Users in some regions need to use vp n or visit regional branch stations; 2. The official APP download method includes: through the official website/iOS download link [adid]9f61408e3afb633e50cdf1b20de6f466[/adid], or download the APK installation package [adid]758691fdf7ae3403db0d3bd

Ouyi OKx official website v6.135.0 Android version download and install

Aug 06, 2025 pm 11:39 PM

Ouyi OKx official website v6.135.0 Android version download and install

Aug 06, 2025 pm 11:39 PM

Confirm that the official website address is www.okx.com, and manually enter it to prevent phishing; 2. Make sure that the Android system is above 5.0, reserve 100MB of space and enable the "Allow unknown sources" permission; 3. Download the APK file for Android v6.135.0 through the official website, and it is recommended to verify the SHA256 hash value; 4. Click the APK file to install, and manually allow "Continue to install" or "Trust this source"; 5. Grant necessary permissions such as storage, network, etc.; 6. Open the Ouyi OKX icon on the desktop after the installation is completed.